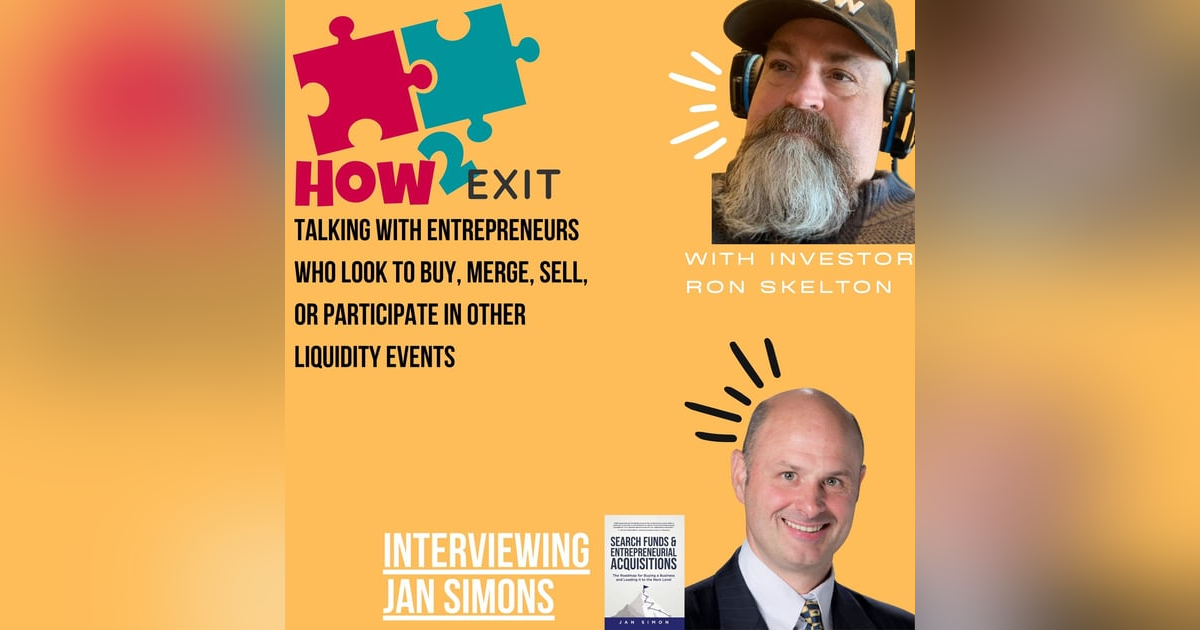

E98: Search Fund Expert Jan Simon On Entrepreneurial Acquisitions Journey - How2Exit

Jan Simon is the managing partner of Vonzeo Capital Partners, a fund that invests in search funds globally. He is the Director of the International Search Fund Center at IESE Business School.

Jan worked for nearly two decades in the investment...

Jan Simon is the managing partner of Vonzeo Capital Partners, a fund that invests in search funds globally. He is the Director of the International Search Fund Center at IESE Business School.

Jan worked for nearly two decades in the investment industry, including Salomon Brothers, Merrill Lynch and Goldman Sachs. He teaches the Entrepreneurial Acquisition course at Berkeley, Cambridge, IESE, and Oxford.

He is the author of Search Funds and Entrepreneurial Acquisitions, The Roadmap for Buying a Business and Leading it to the Next Level.

Watch it on Youtube: https://youtu.be/BB0RH9gddsE

--------------------------------------------------

Contact Jan on

Linkedin: https://www.linkedin.com/in/jan-simon-a3b5405/

Website: https://www.vonzeocapital.com/

--------------------------------------------------

How2Exit Joins ITX's Channel Partner Network!

-Why ITX?

Since 1998, ITX has created $5 billion in value by selling more than 225 IT businesses in 20 countries. ITX works exclusively with IT-enabled businesses generating between $5M and $30M who are ready to be sold, and M&A decision-makers who are ready to buy. For over 25 years ITX has developed industry knowledge that helps them determine whether a seller is a good fit for their buyers before making a match.

"Out of all of the brokers I've met, this team has the most experience and I believe the best ability to get IT service businesses sold at the best price" - Ron Skelton

The ITX M&A Marketplace we partnered with has a proprietary database of 50,000+ global buyers seeking IT Services firms, MSPs, MSSPs, Software-as-a-Service platforms, and channel partners in the Microsoft, Oracle, ServiceNow, and Salesforce space.

If you are interested in learning more about the process and current market valuations, complete the contact form and we’ll respond within one business day. Everything is kept confidential.

Are you interested in what your business may be worth? Unlock the value of your IT Services firm, visit https://www.itexchangenet.com/marketplace-how2exit and complete the contact form.

Our partnership with ITX focuses on deals above $5M in value. If you are looking to buy or sell a tech business below the $5M mark, we recommend Flippa.

Flippa - Real Buyers, Real Sellers - Where the Real Deals Are Made

Visit Flippa - https://www.dpbolvw.net/click-100721038-15233003

--------------------------------------------------

💰If you’d like additional ways to support this podcast, you can become a patron here: https://www.patreon.com/bePatron?u=66340956

►Visit Our Website: https://www.how2exit.com/

📧For Business Inquiries: Me@4sale2sold.com

If you are new to the How2Exit channel, We're happy you clicked on our video! Hopefully, this video made you stay for good!

Don't Forget to SUBSCRIBE to the How2Exit channel and press (🔔) to join the Notification Squad and stay updated with new uploads.✨

👇🏻SUBSCRIBE HERE https://www.youtube.com/channel/UC_ONnhwaKSTPFt2nOxKoXXQ?sub_confirmation=1

𝐖𝐚𝐧𝐭 𝐭𝐨 𝐬𝐞𝐞 𝐦𝐨𝐫𝐞 𝐜𝐨𝐧𝐭𝐞𝐧𝐭 𝐥𝐢𝐤𝐞 𝐭𝐡𝐢𝐬...?

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

👍 Like the video (it helps a ton!)

💬 Comment below to share your opinion!

🔗 Share the video with anyone you think might help :) ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

📱Stay Tuned On Our Social Media :

» Linkedin - https://www.linkedin.com/in/ronskelton/

» Twitter - https://twitter.com/ronaldskelton

» Facebook - https://www.facebook.com/How2Exit

📞Have suggestions, or comments, or want to tell us about a business for sale call our hotline and leave a message: 918-641-4150

🎬SUGGESTED VIDEOS

Don't forget to watch 📽 Our other videos. Please check them out :

▶️How2Exit...

Ronald P. Skelton - Host -

Reach me to sell me your business, connect for a JV or other business use LinkedIn:

Ronald Skelton: https://www.linkedin.com/in/ronskelton

Have suggestions, comments, or want to tell us about a business for sale,

call reach me on LinkedIn: https://www.linkedin.com/in/ronskelton/

[00:00:00] Ron Skelton: Hello and welcome to the How2Exit podcast. Today I'm here with Jan Simon. He's the managing partner, of Vonzeo Capital Partners. And he's the author of Search Funds and Entrepreneur Acquisitions. Did I get that right? Is it Vonzeo?

[00:00:12] Jan Simon: You got it. Vonzeo is right. Yep.

[00:00:14] Ron Skelton: Cool. And you wrote the book, right? You wrote the book on search funds and acquisition, entrepreneurship. Or entrepreneurial acquisitions. So I'm excited to have you on here today. You're coming in today from Barcelona, Spain. Which is really cool that we can spread, I'm sitting here in the Redwood Forest of Northern California. You're in Barcelona, and we get to share your knowledge with the world. And, I think that's, we live in a really cool time to be able to do that.

[00:00:37] Jan Simon: Most definitely. It's a pleasure being here.

[00:00:40] Ron Skelton: So tell us a little bit how you got started in this space. Kind of, your origin story or as you will, and how you got interested in helping people buy, sell and do search funds and stuff.

[00:00:53] Jan Simon: Sure. The short story because, we could talk an hour about anybody's life and that's true also. But the short stories I worked for [00:01:00] about, 12, 13 years in investment banking. Always on the investment side. And so for Marilyn Salman, Brother and Goldman Sachs, and back in 2003, I moved into Academ. I was teaching around investing, at the business group called IC here in Barcelona. And there was a colleague of mine, which name is Rob Johnson. And so the two of us started to become great friends, and he kept on telling me, because we all often talked about, investment opportunities.

[00:01:25] I've been on the investment side, so had he. So we talked about investment opportunities and he told me, you should look at search funds, have a look at search fund. Might be interested in search funds, but, he never pressed on this. And until on they said, Jan, I've seen you many times that look at that. And so I started looking at that. And so I had done my PhD in two things. One thing is how, hedge funds come to decision making, and the other part had been around performance, persistence and investing. And what you learn if you study performance persisting or what you could go call skill. [00:02:00] You see that in investing.

[00:02:01] You don't find a lot of that, at that time. You only find it within private and venture capital. Only in the top quartile. Nowadays it's only in venture capital in the top quartile. And here was an asset class. That study after study after study had an incredibly high performance. When I say incredibly high performance was between 30 and 35%. And so here was an entire asset class, unlike venture capital, private equity, that looks in depending a little bit on the vintage, that had an amazing home one time after time. And that's how got my attention, like, whoa, that's interesting. And so I started to read about it. So it really became on like shop, place.

[00:02:39] And then I started really enjoying the model. The whole idea that you back a young entrepreneurial person. Now try to find a company, then help this person to acquire a company and then help this person to grow a company. I think this is, this was just great and it really connected with my background. So my background had been, well actually, tree Point, I spent some years in Special Forces, then had spent a [00:03:00] big chunk in investing and then by that time I had spent like four or five years, in teaching, in helping the next generation. And that brought it all together because I think there's a kind of a special forces angle to it, but there's definitely an investment angle to it and there's definitely an education angle to it.

[00:03:16] And so I got hooked. And so I started investing a little bit with my own money, and then I wanted to start a front. So I reached out actually to this person, Rob Johnson, who, who had, introduced me to it, but also to a person, another friend of mine, we just called Peter Kelly. And Peter, was teaching the course, board at IC business school as well as Stanford. And he had done that and had been very successful at it. And so I reached out to Boardom saying, listen, Why don't we start off investing in that? And he put at the same match and said, it's a great, it's a great idea. And, but I don't wanna manage other people's money. But Peter said he was an senior advisor to what is, what was the first fund that invests in this space.

[00:03:53] And it is still the largest by a stretch, which is called Pacific Lake. Which was founded by one of the first search, if not the [00:04:00] first search, Jim Sodden and Cory Andrews. And they started investing internationally. And so we weren't introduced to each other, and then, we started work from them looking at the international site, helping with international part. And then back in 2015, decided to start my own fund. And, most American funds only invest in United States. The ones that do outside typically limit between 25 and 30% outside United States. So I decided to get with what had been a close friend of being a very successful entrepreneur in his own way.

[00:04:29] Christopher Pulinks to start a fund, which actually the opposite, about a third of our fund is in the United States and the rest is outside. And that's how we started back in 2017 with our first fund. 2020, our second fund. And at the end of this year, we should, launch our third fund.

[00:04:44] Ron Skelton: I was looking into it. There's a website here that we're, I play, I hang out on occasion. Search funder is what it is. Search funder.com for people who wanna erase search funds. What I've noticed, and I was just gonna ask you, is this true across the border, is just this misnomer I [00:05:00] have though. Is a lot of the search fund venture capital, or you call it funds, people who willing to help fund searchers, they're school dependent. Meaning they're like, if you go to Stanford, there's a group of people that'll fund Stanford acquisition entrepreneurs. There's a fund for that. If you go to MIT, same thing. There's an MIT fund where they primarily, almost exclusively fund graduates from their alma mater, their school. Is that the case that you see too? Or do you guys go across the board?

[00:05:28] Jan Simon: I think it's definitely not what we do. But there's some people who will finance people from Stanford and or slash Harvard. Okay. They're very, very few. Most funds of funds, if not all, like us, we are funds that invest in those people. Okay. We just want to invest in the best talent. Sometimes the best talent might come from Stanford. Sometimes the best talent might come from University of Louisiana. Sometimes the best talent might not even have an mba. Okay. If it would be so easy to say like, oh, you from Stanford, you're going to make [00:06:00] it. It is not the right approach.

[00:06:01] So this is really about entrepreneurship and you find entrepreneurship anywhere. But not at the same time. Not everybody that's going to Stanford to Harvard do any business school is an entrepreneur. And so, I would not say it. What might be true is, and especially in the United States since there's a lot of funds and a lot of funds of funds in it, that if you are an individual person and you have studied at MIT, that your access to MIT students, it's far much easier. To get access to somebody who studied at UCLA and therefore, a former graduate as an individual person, as an individual person might indeed invest. Typically from the place they have, they have graduated. I think it might be a little bit different for people who have done it successfully themselves, but if somebody has never raised a fund, never run a company. No. Has quite some money. And once you invest in the space, then I can see what you say might be true.

[00:06:53] Ron Skelton: So my understanding, and like I said, I've only interviewed one other guy. I told you this before the show. I think I've only interviewed one other, maybe two guys [00:07:00] on search funders. My knowledge in this space is very limited. I'm happy to say I'm fairly ignorant in the space of search funds. My question on that is, is the funds, as it sounds, it funds the search. Often you're funding the individual to, for the year, two years, it takes 'em to find the business to get it under LOI. And then the ones I've seen had some form of, kind of first write of refusal to fund the acquisition itself. How is your structured, or is that common across the industry?

[00:07:32] Jan Simon: So the traditional format and you right to point out, since this is becoming more mature. You start to have different models like cellphone that accelerate and what have you. But the traditional model is where one, what we call a searcher, which is an entrepreneur who wants to own and run a business that is his or her objective. Comes to people like me and say, Hey, are you willing to finance my search? Okay. And so when the person will do that in the traditional [00:08:00] model, and we would be interested, we would not be the only one.

[00:08:03] So typically a search has 12 to 16 investors, 12 or 16 people like me. Which is important cause as a surgeon you don't wanna depend on one person. Okay? So let's say you want to do that, you have 15 people, okay? You want to raise 450,000, okay? And you have, each one will be called a unit. Okay? So everybody gives you 30,000 times, so about that, about 30,000. The K thousand 15, you got 450,000 and that gives you money for two years to try to find a company which are characteristics. It's so difficult to find a company, but it's not easy to find a company which has the characteristics in the industries that we kind of like.

[00:08:41] That makes it so difficult. And I can, if you interest, I can give you the numbers. Okay. So let's say you say you got your 15 investors together. They give you 30,000. Then indeed you have a year, sorry, two years time typically to look for a company within that budget for your salary, your traveling cost, your due diligence, okay? When you find a [00:09:00] company, it gives us the first right to invest. So let's say, and you let, it will typically not be that big. Let's say that it will not be pretty close actually. Let's say that you need 15 million in equity. That means that each of us who has one unit, a 15th of your search have the right to put into 1 million.

[00:09:18] You cannot say like, oh yeah, I actually don't like you. No. You took my money at the beginning. I have the right, but not the obligation to put in all up to million, 1 million. I can also say like, oh, I like it that I'm going to put in 300,000, 400,000, 800,000 all the way to a million and half right? If I do not follow, okay, I get the money back or I get it in equity. So I gave you 30,000, so I either get 45,000. So I get what is called the step up of 50% back, or you might give me 50% in equity. For the people that follow, they have the same deal. Okay? On top of what they put in, let's say somebody follows 600,000, they will also get that 45,000 as a reward to the 30,000 that they give you in the beginning.

[00:09:59] Okay? [00:10:00] That's how we do acquire the company. And then it's up to you to, to grow it and you also get a part that's very important for if you don't know about it. The reason why you do it is, I think, is twofold. First of all, you are an entrepreneur, not the startup entrepreneur type of people, but the type of entrepreneurs that want to run medium size or smaller, medium size businesses. That's the kind of entrepreneur you are. So you would become the CEO. You would typically get as a solo search, 8.3% at the start. So as a reward for finding the company, you will get 8.3% for running it. For the first four years, assuming that you run it reasonably, you would get another 8.3%. And then assuming that you sell it high enough exits, above 30% ROI you would get another 8.3%. So well done. You would walk away with 25% of a company in which you have not put a penny.

[00:10:51] Ron Skelton: Awesome. So what makes an entrepreneur fundable? What traits and stuff are you're looking for? I can see that there are traits that [00:11:00] make somebody right for being a start, like going to VC and doing a startup. They're of the creative mindset. They want to create a business of their own. They wanna disrupt something or whatever. I see those a lot. Mainly cuz I came from that space, right? What's the difference between that type of entrepreneur and somebody that just wants to like, do what we're doing now? Go find a successful business and run it, take it to the next level, and potentially exit for a payday. Right? How do you guys determine the skillset that's required? What do you look for in that guy?

[00:11:32] Jan Simon: There are some commonalities cause they're both called entrepreneur, but there's a couple of different things. I think a startup entrepreneur is I think to certain extent, more creative as somebody who want to create something out of nothing. Okay. Because that's where the start of it. It starts with an idea, with passion, and then you create and you create that. Okay. And typically those people like to bring something from, you could say zero to a hundred. Okay. And then they have great ideas. Often those people, like, you meet them a week later and have another idea. Their head spins [00:12:00] out, idea and idea generation. Okay.

[00:12:02] That's not our type of entrepreneur. Our entrepreneur is somebody who really loves the idea from thinking, taking something from thousand and bring it to 10,000. Okay. Something where the question is not will this work? Yes, this works. This has been working for the last 30, 35 years. There's a structure in place. We don't talk about proof of concepts anymore. No. This is a company that's really doing and doing well. Now the question is, can you grow it? The question is, can you inspire people? The question is, can you find out new products that you might also sell? The question is, can you redefine strategy?

[00:12:33] And so that's why not everybody, but a lot of people, about 80% have an mba because those are the kind of discussions you have in an mba. Okay? Typically, entrepreneurship is a course in the MBA where you leak about creation. But the CEO has to know about strategy, has to know about operation, has to know about finance. All those other courses typically that you see in the MBA connects well with that. What we often see is, we have people who went to the MBA because they wanted to be an [00:13:00] startup entrepreneur because that's when most of the people think about an entrepreneur. They think about Elon Musk. They think about Steve Jobs, they think about those startup entrepreneurs.

[00:13:08] At business school they learn that they're different kind of entrepreneurs. And then they learn the model where it actually, you don't have to have an idea, but you want to be CEO. That is a format that will give you that. Okay. So that's a little bit different kind of employer. What they both have in common of, should have in common is passion for what they do. What they both should have in common is coachability. Okay. Because both have something in common is that they do not have any experience in managing and running companies. And that's a high risk proposal. One of the reason why our model works is because the unexperienced CEO is surrounded by amazing boss with people who have great experience, but if you don't have the capacity to listen, what point isn't having a great board?

[00:13:51] There's also tenacity. Okay. Being the first time CEO, things, wheels are going to come off, and we expect that as investors, and hence, you need the tenacity, which [00:14:00] is true. As a startup entrepreneur also. Okay. But, so just to make the point, there's some things in common, but there's really a difference in terms of what you want to do and the type of mess that you're willing to take on. Okay. Startup as you, you will have to see now that's really, really messy. Okay. Ours is already working. Typically they make a little bit of a mess after that, but it's far much more controlled.

[00:14:23] Ron Skelton: What happens to these search funders if they don't acquire in the first two years? They have to raise more money, or what happens at the end if they don't, if they don't find?

[00:14:33] Jan Simon: A company? It's most of the time, not that they don't find a company, it says that they find a company, but the investors don't think it's a good company. Okay. And so that happens, about, between 25 and 30% of the people who do not find a company. And when we discuss that part in the classes, that's what scares a lot of students. And I tell them that is not where the risk is. And it comes exactly to your question. Like, Pacific Lake, which I said, is the big one in this space. They actually looked, what [00:15:00] happened to those people we backed, that did not find a company.

[00:15:03] Okay, close to 60%, two years after they failed and closed their search. Close to 60% has on their business card, CEO. So they come to that. Okay. Just not through the traditional search assertion. Okay. Not finding a business. It's hard to find those kind of businesses and they didn't find it, but they did a great search. If you do a great search, one of the offspring of that is that you are CEO already. That's what of the, one of the things that people often don't see. They think like, oh, I have two years to find a company. You have two years to find a company and be ready to become CEO because on day one of your search, you're not ready to become CEO.

[00:15:45] What this process does, it helps you to become ready. So that's number one. And number two, I think, which is probably close to 25, 30% typically works for a private equity firm. Okay. Because you've done a lot of sourcing, you start to understand what is a good company, whether it's not a company. You [00:16:00] typically have done a couple of negotiations. You definitely have LOI's, you definitely have due diligence. And so private equity likes to, to take on those people. That's the not where the risk is. The risk is buying a company in destroying value. That is where the risk is. Okay? Because then once this is all done, you're like seven years, eight years down the road, and you don't have anything to show for.

[00:16:21] Okay? And so in that sense, you are aligned with your investors. Your investors don't want you to buy a bad company, nor do you. Okay. So of course if you don't find a company, you close your fund. It feels like failure, but people get over it and definitely then either become CEO or typically work for private equity.

[00:16:36] Ron Skelton: Now, does that pool of 10 or 15 investors become advisors also along the path? You're not gonna throw your 50 or 30 or whatever thousand dollars into this search fund and then stand back and watch the guy fail, right? You're gonna, I mean, there's advisement going on. There's like, check-ins and checkups and consulting type of, making sure, preparing him to be ready or her to be ready for, to be a [00:17:00] CEO, right?

[00:17:01] Jan Simon: That is correct, but at the same time, it's very subtle. Okay? Because, I could be breathing down. You next say, how many calls have you made? Have you talked to this person? How about this, look at this database. What that would do, it would increase the probability of you finding a company. But it will do two other things. It would make you less see already. Okay, because you just have executed me. And the second thing it would also do is you would find, you're an employee of me. You don't want to be an employee. You are an entrepreneur who wants to become CEO, which is a very different thing.

[00:17:31] And so first, it's very subtle in the sense that we don't want you to fall off the tracks and lose months, looking into business, which was never in the cards to be acquired or shouldn't be acquired, you know? And so when we see that, we'll bring you back on the tracks, okay? But at the same time, we want to give you more space, enough to grow in this unstructured environment to become a CEO, okay? If you would want to be an employee, you would have taken another path. And so that you don't feel an employee of this. And I think that's typically what you find with the, with experienced [00:18:00] investors. Sometimes we see new people coming in this space and very well meant. They really are on top the CEO trying to help him or to her. And, typically that at one stage that's not helpful anymore for this person.

[00:18:13] Ron Skelton: Where has the space went, been, and where is it, do you think it's going? So in the last 10 years, maybe 15 years, you've been in it for at least that long. In the last 10 or 15 years, where does it come from to now? And then can you, I'm not asking you to tell the future, but can you kind of tell me where you're from, your experience, where do you think it's going?

[00:18:32] Jan Simon: Yeah. So there's two, studies, there's two centers actually who studied it pretty intensively. One is at Stanford, looks at North America, and you can call to the webpage, which is the Center of Entrepreneurial Studies. They have great research on that, which is accessible. But they also do every two years to do, study of the North American space, which they define as, US and Canada. And so we look at the rest of the world. And so what you will see is like, for the first, I would say probably [00:19:00] 25 years, That really was under the radar screen. When I say under the radar screen, that means that a couple of people a year would do it. Okay. So a couple here, a couple there, and then you get a first kick around, 2010, it really starts picking up a lot.

[00:19:14] And then you get it also in 2017. And in North America it have, it seemed to have blood to now. The last two years has kind of been the same internationally. It's still taking off. If you look at the numbers, they're particularly small because, like at the central research, I think last year was 66 people who did it in North America. There's a hundred thousand companies that are for sale without, with that kind of size. Okay. So it's not that all of a sudden are this is saturated. It is not. But I think there's a heel, there's an Achilles Heel. There's a point, which we have to be very careful of.

[00:19:46] This is really high performance. And if you look at any environment of high performance, look at business, look at sports. You always get yourself the same combination. All expands people [00:20:00] and young raw talent with a lot of passionate level of energy that come together. Okay? This is also the, one of the secret parts of our space now, as long as it was a couple of people a year, what happened is, the previous generation of searchers who had been operators would help the new generation of search and operators, okay? One that takes off. You don't have that bandwidth in terms of board capacity. Which is an incredibly important part, okay? That's for me, the weakest. That's one of the two weak points, okay? At this stage is that we grow too fast, we get weaker ports, because one of the things that we find out, and there's actually a great font, which is called TTCR, which also does a lot of research.

[00:20:39] And one of the research, by looking at the top 25, 1 of the things their research shows is that if you look at the top 25, 95% had the wheels coming off in the first three years. Really the wheels coming off. And so here you have a company which is really govern of the track, and what helps it back on track is that you have great [00:21:00] searches with great characteristics as a character in terms of ethical people also with a good head, but you have a great board, okay? If they wouldn't have had those board over that quality of searches, the story that would write about search fund would not be as great as it is now. And so if you want to keep on that going, we need to make sure that those boards are, in place. But you also may have to make sure that when you go to your 15 investors, you know that you have six or seven investors and needs there that do hard due diligence together with you.

[00:21:28] You'll do part of it. But this first time you typically do that. So you want to have a certain part of your investors also do hard due diligence. Since people see the performance, someone is coming in there, which kind of wants a free right. You have your 12, 14 investors, well some of them will certainly do some due diligence with one thing. Okay. And that we have to be careful of. That's why we see, what we think are great searches. They really pick and choose who they want in the cap table because they know, like once I want to look at the company, I want to have people who do due diligence. [00:22:00] Once I acquire, I want to make sure that I can put the grade board together. Okay. And so I think the smart people or the people who have done their own due diligence before deciding to do that, before deciding on the cap table, I think look at those things.

[00:22:14] Ron Skelton: So can you walk us through the process, like step by step this, if somebody wanted to do a search fund and reach out to you. They need to already have their private placement. In the United States, there's certain paperwork we do for raising money, right. Private placement memorandums and that type of stuff. Do they need to have that in place? Or are they just like they bring to you, fill out some type of, I don't know, some type of resume, some type of thing and say, Hey, I'm interested in that. What is the process for somebody to get started in this space?

[00:22:38] Jan Simon: The first thing that somebody should do, figuring out is this your part? And so do, and then the question is, do you really want to be a CEO? Of a smaller, medium size company, if that's what you really want. Okay. That's the first question. And if the answer is yes, then the second question is, how? Because as you alluded to, like there are other formats. Some people finance the search [00:23:00] themselves. Some people can even find finance acquisition themselves. Some people are going to work in an accelerator. Some people are going to be entrepreneur in residence. Some people are going to look for another model. So there's different models out there. There is not a perfect model, okay?

[00:23:14] You'll ask somebody, in a traditional search, they'll say, this is the best thing. You'll ask yourself and they'll say, the best thing this is whoever a best format for you. Okay. So that's why you want to do the due diligence on that. Once you decided I want to be a CEO, you figure out what is my format. If your format is indeed a traditional part, okay, then you reach out to people like us. Now, a lot of people reach out to know more, to have a coffee, to have a chat, there to diligence about it, and that's fine. But when you say you're serious, that's when you sell the PPM. Okay? We see a lot of people who talk and they're really convinced that they want to do that, and we never hear from them again. Okay? One thing, a PPM is a little bit of work, and that's kind of a barrier to entry. You're typically only going to do that once you figure out, yes, it's what I want to do. And so that's typically when they [00:24:00] reconnect or they connect for the first time. They said that, search and search. I really want to do search in United States.

[00:24:04] Here's my ppm. Would love to have a meeting and then typically have a first meeting. Sometimes we have a second meeting to decide, what if we, from our site or other investors are going to invest. Now what they typically will find, is if you have 15 units to put it like that, that place in the first two or three is hard, hard work because everybody wants to know who else is in there. Okay? But you see like once you get some good names in there, or at least soft commitments with good, some good names, it picks up. And so then one of my advisors to the people said, do not stop when you have, raise your 15 units. Okay. And you know why is because you are not raising money, you are raising resources.

[00:24:46] Okay. And that's very, very difficult. If it would be just my money. Once you have the money, that's it. No, no, no, no, no. Okay. So since this is long term advice, you want to make sure that you have the right people on your train. And hence you might want to try to convince other people until he said, you know what? I have now [00:25:00] have 20, but without that 15 I can, that's really the team I want. Okay. And hence you phone to five thing. Oh really? I was over subscribed. Let's stay in touch. Okay. But this is your journey and hence, you want to make sure that is right. And from then on you start looking. A lot of people take close two years to look. So I give you the number just that's from show that, so people reach out who do that, to buy one company, they reach out on average to 3,600 companies. Of those, they get answers of 256 of those, only 125 are positive answers. Okay. The rest is like, you spam leave me.

[00:25:40] I don't wanna sell to private equity. No. A whole bunch of stuff. Okay. We, not private equity, but some people think we are, might think we are. You have an ultimately conversations or meetings with 25 because of those 125, 50 have asked for more information. How that with, this might be too big. It might not, it might not be for sale ultimately, [00:26:00] whatever. Okay. You have price conversation with 16. And so one of the thing we teach and one of the thing we explain, okay, you do not have a lot of time. The seller has all the time, okay? And everybody wants to know like, how much is my business worth?

[00:26:15] Okay? That doesn't mean that they're ready to sell. So as soon as possible you want to figure out two things. Is this a real seller and are we in the same ballpark when it comes to money? Okay. Because if Thomas say, yeah, all my businesses worth 10 times sell, run. Okay. He said like, well, I'm not there. If you change or might investor change now let's call. But, let's move on. So that's why he see, they have 16 price conversation, they have five, otherwise. Okay. I always tell my students like, and like, getting engaged, okay. Cause there's a lot of work on that. You don't do that for fun kind of stuff. And your time is limited and your resource are limited. The five to come to 1, 1, 1, 1, 1, 1, 1. Marriage. No. And so this is a hard, this is really a hard process. And so that's why that necessity comes in. [00:27:00] Let's say you find the company, okay, we will help you when, stretching the deal. LOI. Okay? Doing the due diligence.

[00:27:06] As you said you had the military background, but in the military you often say, time spend on working, send to seldom racist. That is your due diligence, okay? And so that's where we play the money of our investors. It's on our due diligence. That's the most important thing for us. It's even more important for you because we invest in about 25 searchers a year. You will do one acquisition, and that's going to be it. And so for you, that's incredibly important. We'll help them. You do it, the process, you hopefully acquired the company, and then we'll also help. What do you do in day one? How do you present yourself? What questions are you going to get asked? How do you answer to that? Okay. And then little by little you do. Now, the, one of the tricks is to buy a good company in a great industry, okay? Because you want to buy, since you don't have any experience you want to buy a company with, as a matter of speech, you don't have to do anything where things are going well.

[00:27:50] And so you do that where your board also has learning. So the first year is really about you learning. It's about your board learning, okay? And then typically, changes started [00:28:00] to be implemented, in the second year, 16, 18 months. That's an actually when you start with each changing the strategies, changing the business model, opening an extra, sales point or whatever it might be. Putting scalable structure in place, whatever it might be. And that's how typically the value is typically generated between year three and year six when you exit.

[00:28:20] Ron Skelton: You just said, when you exit on that is that the game plan for most of these? There's a time span where you're going to help them buy it, grow it, and then sell it at some, on some liquidation type of type frame?

[00:28:33] Jan Simon: Not necessarily. So the exit for an investor is not necessarily the exit for a CEO. And that's important to know because, we often have CEOs, that don't, for you as well. And they say like, I want to sell. And when the boards are like, are you doing fine? Like, why want to sell? They say, well, on paper I actually have 35% because the business has been growing up at this valuation. But this, we bought this business with 10 million sales. I grew to 35 million sales. Now [00:29:00] from doubling from here, that is not that easy. And so that's when the good port will sit down with you and say, listen, you've done a great job. We can venture your 25% today. We can actually venture 25% today, and we can actually gave you an extra 5%, into the future if you hear certain milestones. Okay?

[00:29:14] But however, the investors will at one stage want to exit. Okay? Typically, they want to exit. And depending you, you have people who want to, to happy to sit in there for, 25 years. There's typically a natural progression, from new investors. Okay. And that doesn't have to go together with the CEO. Like, Kevin, which has been the most successful CEO in this space. He was the CEO for 25 years. Now the investors have changed. A venture capital came in and private equity came in. Okay? So that has changed over time, but that, not that necessarily have to be. What is true however, is, if the CEO surgeon, wants to get off, we typically get off too. It's all, either strategic and they'll have their own CEO or to private equity and they'll bring their own CEO.

[00:29:57] They might ask for the leaving CEO to stay on for one or two [00:30:00] years. But that typically is because, this is such a personal relationship between the CEO and ourselves. Okay. Then when, as a very famous investor, Bilek will say, like, when the train driver gets off the train, I get off the train too. No. And so that typically goes together, but not the other way around necessarily.

[00:30:16] Ron Skelton: In your eyes, what separates a search funder CEO, you guys fund that succeeds from one that fails? Like what are the indicators that, you've done this long enough, you've seen, I'm sure you've seen people fail too. What are the indicators you look for now that is an indication somebody might fail at this?

[00:30:36] Jan Simon: It's a great question because Alexa goes back to the two decisions that we make. You invest in the search and you invest in acquisition. So we play the money in the acquisition. So on typically a search is about 30,000, but acquisition is about a million. And so you can see where we put the chips. Now, when you invest in the search, you know we have some characteristic and we did, we discussed some on your show kind of stuff. But it is a very [00:31:00] difficult exercises and the main reason why it's a difficult exercise, is because most of the learning, when the searcher come to us, most of the learning in their life has been structured learning.

[00:31:11] They went to school, they did exams, they graduated with good notes. Then they went to work for a company where they had a boss who tell them what they were supposed to do. And when they did that, well, they get a nice bonus. If they didn't do it well, they didn't get a bonus. Then they go to business school when again, it's structural learning. They have quizzes, they has exams. So, and all of a sudden they start the search and there's nothing. I'm not saying, Hey, I, there's nothing. So this is all on structure, who they talk to, how they lead their processes, totally up to them. And so what we'll sometimes see people will say like, whoa, this has, this person has all of potential.

[00:31:44] Two years later when they acquired the company, they're still the same. They haven't moved on. And then sometimes you have people say, oh, I don't know. Two years later, they're really ready to become ceo because they have learned a lot in that, unstructured business. And that's [00:32:00] my connection with the special forces. That's what special forces do. You take somebody who's a civil, you go to six month training program and they're ready for very unstructured operations kind of stuff. And this is, this is the same kind of idea here. Okay. So just to make the point that you cannot always, you typically cannot know how people are going to live in that unstructured environment because typically they have not done so.

[00:32:21] However, there are some characteristics of importance. What are these? Okay. Humbleness. Okay. People that are humble have the capacity to listen. They have the capacity to listen to investors. They have the capacity to listen to sellers. Okay? That's important since they're not of experience. People that are hungry, okay? Because, 35% returns. I take my head off all those entrepreneurs every single day. You have well paid CEOs of big company with all means, and they're happy with 8%. Those guys on average they do, 35%. This is amazing. Okay. Okay. So, Peter Kelly at Stanford call that, being ambitious, being humble, but [00:33:00] also being ambitious. Okay? The capacity to work hard, the capacity to take it on the chin. Okay, go home and get back the next day and get back up. So that capacity to actually bounce back very, very fast, okay? The capacity to be positive. If you going to lead positive, typically people don't like to work for people who have half depressed all the time.

[00:33:18] People like to work for people who are optimist, creators find solutions. Okay? So I think those are some of the important characteristics. Some people have them in more those than other people. What is the only characteristic that you cannot compromise is ethics. Okay? You cannot invest and you should not invest in people who cut corners or people who think it's okay to cut corners. Okay. That's never going to end well. And then that's something that I think this, this space has done very well, and is very collaborative. Now, what makes this space very different as a collaboration? Okay. The investors, will always help. CEOs will help searchers.

[00:33:53] Searchers will help actually people who think like, oh, I'm thinking about doing that. So the collaboration in this space is just, really, really, really amazing. [00:34:00] And that also is a question like, if we keep on growing so fast, does everybody who comes into this space understand that? That it's about giving forward. Like if somebody wants to invest in this space, I'll help this person. But this person takes on a little bit of van, like in four or five years. If somebody comes to you, wants to be an invest in the space, you should help her too. You should help him too. We need to be doing that. And if you grow fast, you've seen that enough and startup, you, there's a great goal. Everything goes great. Then they have a great service. Then they have to attract a lot of people. and to keep the same kind of culture is not easy and you have to make active efforts to be able to hold them.

[00:34:37] Ron Skelton: So we talked about you guys selecting the entrepreneurial? What the entrepreneurial criteria is. You get to work with them for a year or two, so you really get to know whether or not they got the merit or the stuff, or the mo, or whatever you wanna call it. To make the acquisition before you cut that bigger check. And then like, we already talked, there's a due diligence. You guys help with the due diligence. You want your board to jump in and do their [00:35:00] due diligence. So there's multiple eyes looking at that. What would you say is the most difficult part of that? In my mind it's might be like, now you got this new operator, he's in this seat running something he's never done before. Maybe this, if he's straight outta college, this might be his first big company he's run.

[00:35:17] What's the most difficult part of this to make sure that they succeed? And you have the long term goal as you, as a, venture capitalist or a, a guy who owns a venture fund funding these search funders is that the other people, you and the other investors that work with, you get an exit and you get more money to help more people, right? You get to do this again, rinse and repeat. So what's the most dangerous spot for you guys that, that you see?

[00:35:43] Jan Simon: So you're totally right, but therefore, the way to look at it from in this space is by looking at risk. That's one of the things I learned at the go. Like first look at risks, see if you understand the risk. See if we see what the risks are, and then see what return you could get for it. And if that justified. If you look at it from this point, you [00:36:00] are spot on. There's an amazing amount of risk in taking somebody who's never in the company, to run a company. Giving that is very, very risky proposition. You look at all the other characteristics, they should be low risk. So that's why the industry is important. We will often say we buy good companies in great industries. What does that mean? It means that the industries are not a lowly cyclical. It means that the industries are fragmented. It means that the government doesn't play a big role in those industries, okay?

[00:36:30] It also means that those industries are not CapEx heavy, okay? If you look at the company, it means that the company typically has a big, a big proportion of recurring, if not repeat revenue. It means that this company is growing. It means that it has strong EBITDA margin. It means that the company is not complex know, and so forth and so forth, okay? So that all those other pockets of risk are low, so that you can indeed put indeed this unexperienced operator and put in and hinder her. Okay? Fast forward five, six years, [00:37:00] you still hiring in great industry with a, with now probably great company. But now you have an experienced CEO. Okay? And that's what explains, in NHL that's those high returns.

[00:37:10] Now coming to your back, your question like, like where does most of the risk like? It's indeed, this young entrepreneur that either doesn't listen, okay. That is not transparent. No. That, let's say, loses the biggest client. That's not typically one. We don't like Caroline concentrate, but say like you have client concentrate, lose, the biggest client doesn't say anything to his or her board for a while. Okay. Those are kind of the risk that goes with that in inexperienced kind of stuff. Okay? Also, sometimes, a type MBAs feels that they know the CEO, they have to do something. You have to learn. That's the only thing they have to. Try not to screw up and learn. Okay. And sometimes what we often see is act like they want to do this, they have this idea.

[00:37:51] And if they run too fast, without having that capacity to run or without having learned that indeed, maybe we should not sell that part of the company or downsize. Maybe we should actually [00:38:00] do that size. Okay. Which is the same thing. It's too far. It's not only the search, it's too forest investors. There have been several times that we think because you always have a thesis in advance. Okay. That after year, where you really know the company, you see like, good thing that we didn't do that. So it goes with that inexperience and that's typically where we see, the things going wrong. Okay. Or a company that you thought was not really sensitive to the recession. Well, COVID is another type of recession than the ones we've seen so far. So something like that happens, you will have to deal with them.

[00:38:30] Ron Skelton: You mentioned the fragmented industries as being one of the criteria. Do search funds actually help do the growth through acquisition? Where you help acquire the first one, they run it for a year or so, everything's solid. And do you grow by acquiring other fragmented businesses in that space? You encourage that and does, how does that play out?

[00:38:50] Jan Simon: Well, the way it actually works is it can never be the thesis, or it should not be the thesis when you take over. So when you come to your investor, say like, I really [00:39:00] like this company. Okay, they have to understand that this is a good company in the greater industry, okay? And it shouldn't be a thesis of acquiring more acquisitions because, doing acquisition and especially, doing acquisition is easy, but well, relatively easy. It's the integration, is what's difficult. So if you look at the statistics, of the experience professional, there's only about 25% that creates shareholder value, by doing m and a. Okay. And it's, the reason why they don't, it's three, it's strategy, it's finance, and it's pmi.

[00:39:27] It's integration. And the integration is the big one. And within the big one, it's typically culture. So can you imagine somebody who would run a company, that being the, in, the thesis from the start. So we kind of don't like that. If it's kind of next, and by the way, we could also do that's another story. Now, you're totally right. Fast forward 3, 4, 5 years, if this person is in an fact industry and is now an experienced CEO who really has a good control and runs a company, well, that has often, well, that has an certain, amount of cases been the situation where he or she kind of [00:40:00] acquires and integrates, acquires and integrate.

[00:40:01] I was mentioning the name of Peter Kelly which an incredibly successful searcher. No typical situation or the beginning, really not good learning the business, strong search, putting the business right. Ultimately the 25 acquisition integrations, but I would say it's only, it's typically only after year five to six. In a simplified model, what you could see three steps. Okay? The first three years are, where you learn and you start doing, some major decision making. Okay? And that runs into year five to six. Where you see the fruits of that decision making. And that's when most of them will actually move on or be sold.

[00:40:38] Or when the investors kind of change. But the ones that stay in, typically seven plus, what you typically see is they're the big financial decisions. Higher level of leverage, or indeed, as you see, do m and a. But that's typically the third wave where, you know, and I don't have data on that, but out of the top of my head, I would say is probably 15 to 25%. Who still does the [00:41:00] last leg. And we have the search investors are still involved in.

[00:41:05] Ron Skelton: I think we missed this step inside of here and I want to cover it. Cause I, the last time I interviewed so many people reached out to me and go, how did you do this? Where did the investors come from? Is that from, like, if I were to start a fund, do a private placement memorandum, send an invitation to you taking a coffee, am I reaching out to my network and looking for the rest of those investors? Or do you have certain people you would ring in cuz you wanna work with them? You've worked with them in the past. How does that building that 15, 20, 25 people to select to be on your board and to be on, be your search funding investors? Where does that come from?

[00:41:37] Jan Simon: So typically people who have interest in it would go to one of the searchers conferences. There's multiple, like, Harvard has one, Kellogg Booth has one, Stanford has one. And then you would meet multiple investors. So typically, you could find that. You just Google it and you'll probably find some investors and you would reach out to him saying, oh, I'm going to be at the Kellog Booth conference. I going to be there. Could I have a coffee too? So that would be one way to do [00:42:00] it. But another way is indeed reaching out to investors and saying, like, doing a meeting with them and then ask them like, what other investors should I talk to? And we will say like, well, for you giving that you know, you interest in this and that. Why don't you talk to such and who could easily, either give you the emails or, because that's what we do.

[00:42:16] It's not like, oh, you're giving somebody this email. Like if another investor thing that you are great. I would love them. Give my email because that's what I do as a job kind of stuff. And so you would very fast kind of new the people who, either, it doesn't have to be on funds or funders. There's really individual investors, which are great to, to have on your cap table, but do that as their job. And, they invest their own money, but they're very active and very involved and have great advice. So you'd find out very fast those people. The other thing, and that you should always do that, one of the few things you should definitely do is you should talk to other searchers saying, listen, how is that? How is it when a deal doesn't go through?

[00:42:53] What is the kind of stress? What would you wish that they would have told you? And then you also ask them like, can you introduce to [00:43:00] some of your investors? Who should be the investors who kind of, which are kind of the investors that have been helpful to you? And you take note of that.

[00:43:07] Ron Skelton: What are the key legal, considerations that come into play during, in this, I know there's gonna be contracts and that type of stuff. When a CEO steps up and they acquire something, like if I go buy a company, like I bought a tiny, I bought a pest control company. It was way too small, but I bought it. I bought it, but it pretty much just bought the equipments and the customer list cause I couldn't buy it. They had too many things they had done in the past that I wasn't willing to take the liability on for, and there was no way, because it's an, EPA regulated and state regulated thing.

[00:43:38] There's just no way I wanted to take on that liability and there was no way to really clean it up. They had too many years of not keeping the records right. So where does that liability fall? Is it on the CEO? Because he's taking the ownership on it and everybody else has just kind of got this limited liability, responsibility of, I'm an investor in this, but I don't have, my concern is if you [00:44:00] miss something in due diligence, I mean, JP Morgan just missed something in due diligence if you've see in the news, right? Frank or whatever the name of the company spoofed their user count to the tune of millions of, dollars. I'll be surprised that the lady has her name, Charlie, or whatever her name was. I'll be surprised she don't go to jail. Um probably should. That said things are missed occasionally. There's a liability, beside that. And that was fraudulent. But there are just things that are missed. It could be a lawsuit that's pending. Sexual harassment like, doesn't show up for six or seven months. How does that liability play? I mean, you guys risk your money cuz you're investing it, but the legal liability of the companies that fall on the CEO that's acquiring it or how does that work?

[00:44:36] Jan Simon: So we cannot do what you did, and I'll explain you in a sec, why that is. This three or four reason why you do due diligence, okay. The first reason is to answer the question, should I buy this company? Yes or no? The second one is, should I pay the price that I put in my LOI? Am I put LOI, I put like 10 million or five times EBITDA, whatever it is. But now I find that million dollar liability. I can [00:45:00] easily go back and say, listen, I said 10 million, but it's going to be 9 million. Because there's a liability or at least we have to negotiate. And the third one, which is also important, is there's something in the purchase agreement, which is called the reps and warranties.

[00:45:12] So if liabilities comes up or they're not clear, that's where they go. So you, the seller, you make a representation that there is no sexual harassment, there's no court case. That's in the reps. And if that's not the case, the warranty is like we have it because we think there is, for instance, there's going to be a screw account in here, which we can hold that against or against the seller note or whatever it is. So that's how we typically solve it. And the reason why and what you refer to is, you bought the assets, you didn't buy the company. For us, that becomes far much more difficult because you bought a B2C company. We buy typically B2B companies. And if you do that in B2B companies, that means that all the contracts that the company has with the customers have to be redone.

[00:45:54] So that doesn't work with us because all of a sudden, the reason why you buy the company is they have those recurring contracts that lost for like. [00:46:00] And all those have to be kind of renegotiated. And that's why we kind of typically cannot do that. And so that's why our reps and warranties is going to be very, very important and has to be very well negotiated. Also and last remark is, and that's why you know it's so important that you have lawyers who do this, which is small and medium size acquisition for a job. Not any lawyer. No. Not the civil rights or, no, no, no. Not the constitutional people who do that. It's equally important that the seller has somebody who does that as a profession.

[00:46:34] And the earlier you can advise the seller to have lawyers who do that for a business on his or her side, the better. One of the biggest reason that the acquisition doesn't happen is because the seller does not have people like that. Okay? Because what we actually do, this is a really trust relationship. This is typically the first person, first thing that the seller sells, and it's gonna be the only one because. He or she [00:47:00] typically retires. And this is also the life of the search. So this is very, very personal and that's why the seller sells to you. If the seller all of sees those reps and royalties that would break the deal. They'll say like, I thought you trusted me. I thought you're going to buy the business for 10 million because the last time I sold something was my car and I got a check and he or she got the car. And now there's all those conditions. If you have to explain at that moment, that's normal. The deal is going to be gone off. Now if his or her lawyer said like, well the next step is going to be reps and warranties and there's going to be that and that, and then sees your reps and warranties.

[00:47:36] And here she says like, yes, that's how it is. And not go to sell the company without that, that is very different. And so that's one of our many advices we would have, to the surgeon. Like, this seems to be serious. Tell the seller that he or she needs, people who do that, not the uncle who's also a lawyer. No.

[00:47:52] Ron Skelton: I've seen more than one deal fall apart because the family lawyer. This guy has been my lawyer for 20 years. He's set this business up like, yeah, but he's not an m and a attorney and this is [00:48:00] gonna do that. Now, do you guys require, reps and warranties as insurance? There's insurance here, at least in the United States that handles, it covers the reps and warranties.

[00:48:09] Jan Simon: That's fine. As long as the insurance company, is a strong insurance company. One of the reason that AIG had to be saved is if it AIG would've fallen. A lot of banks would have fallen not because of market risk, because of counterpart risk. And so if that, job as for instance, very active enable, there's more, insurance company which are big, which are, well capitalized or well regulated, who are involved in that. That's fine. That's fine with us. Yeah.

[00:48:31] Ron Skelton: We keep alluding to it and talking about size of the company and search criteria and stuff, and industries and recurring revenue. What is the size and industries you guys like and to counterpart that, what are some things you just won't touch?

[00:48:44] Jan Simon: In terms of size, we typically talk about companies between one and 5 million of EBITDA. Big chunk will probably lie under the 3 million. And so the sweet spot is like two and a half, 3 million is kind of the sweet spot for us. Under the million, and even around [00:49:00] the million, a lot of search things like this is great. It's probably easier to, grow something from 1 million to 5 million than from five to 25 million. It's actually not. So smaller company, if you look at, no, that's not, if you look at success than failure, okay? There's far much more failure in smaller companies. And there's a couple of reasons for that. The first reason is small company gets done the tin. It might even often be game over. Secondly, you buy a small company, you're the CEO of everything. Here's your CEO, but every single decision is going to come to you. Why? Because there's no structure to scale it.

[00:49:30] And the third one is, you're a small company, try to attract an A player from another company. You'll see how much, how far that's going to go. And hence, if you buy a certain critical size, all those three things are easy. So typically, as I said, one to 5 million, around 2 million is kind of the sweet spot. Growing industries is important and so we like typically industries that grow, either at, but hopefully about 50% stronger than the overall GDP growth. And then companies of course that have mode. Companies that you say like, okay, we understand why your customer come [00:50:00] to you and that's defendable and we think that's sustainable, and what you want you to do now is grow that mode kind of stuff.

[00:50:05] So those are some of the important things in terms of size. Now in terms of industry, what you will often hear from people like myself is, we are not sick to the industries, but we are not agnostic to the industry's characteristics. And that goes back to the low pocket of risk. Some of the characters that, that we said. Now, as a consequence, there's some industries which are decreasing that would not be of interest service. And there's indeed some big issues out there. Like the agent population, being one of them, the healthcare being also connected to them. But larger than that, Medicare ed will become under increasing pressure.

[00:50:36] So there's some growing trends that, in their security. Where you typically, you see that, a lot education. So you often see connected. So it's often healthcare, it's often, education, what have you. One of the trends we've seen, to one of your early question and connected with that is, in the United States, mainly like the two biggest sector in terms of, search fund activity has been software, which in the original, search fund, we didn't [00:51:00] see that. SaaS enabled businesses, technology enabled businesses have as of late last four to five years have been of, of interest.

[00:51:08] We are actually only have, we invested quite a lot. We only have turned once an investment down for ethical reasons. So industry characteristic are of import. But there was one, a good company, and had great numbers and the industry was also pretty, good. And what this company did, it had a technology which allowed to develop energy in a very fast, very fast spare of time. Typically, technology, for instance, is used in airbags. That kind of technology. And so all kind of good, had a lot of customers, fragmented industry, lot of smaller players, IP protection. But one of its customers was actually, one of the, without saying the country, one of the bigger, countries in terms of defense.

[00:51:48] And so they actually, provided technology to the submarines to unleash nuclear warheads. And so we didn't want to, we, again, no judgment of other investors who follow that, but we invest money of our investors, [00:52:00] and we also reached out to them and explained it and a lot of them didn't want to be connected with terminology and indiscriminately killed 10,000 of people. At push off a bottom. No. And so we decided not to invest in that. But typically, it's more about the industry characteristics and the company characteristic. And also, if I might use this question of yours to put out two things, the two things that we typically see searches under, underestimate, is what is their own competitive advantage. When they look for a business, not everybody is like you. And hence, what is your own competitive advantage? Because that often will connect very well to sell it. And the second one is, what is going to be the exit of this company?

[00:52:37] Because there's a lot of companies that are growing that are fragmented industries. But not all is that clear that in four or five years it's going to be, an exit. And if your only ideas like yeah, one day private decade is going to be interesting in that's not strong enough. And we often see them struggling with that in the beginning. No, after the year of searching, they have, I think they've heard it enough that they understand that these kind of businesses are not the type of business that we might [00:53:00] want to acquire.

[00:53:01] Ron Skelton: Awesome. Well, I've asked you a lot of questions. We're right at the hour mark. What should I have asked? What did we miss?

[00:53:08] Jan Simon: What did you miss? You went to the entire, entire set up pretty well. I think maybe the only, thing I might add, and then I can do that in two seconds, like, a snapshot about the other models. So the cell phone that is indeed where somebody doess that themselves. Either the search and or acquisition. Those people tend to buy other types of businesses. So they tend to buy smaller businesses, often more lifestyle businesses, but businesses that are rich and generating cash. Since those are mature businesses and that cash doesn't have to be needed to grow, they can leverage that more. And so that's what we often see the searchers doing. The other format is an accelerator model. Just like in, in the startup world where you know, you're not going to have 15, 16 investors, you're going to have one investor, which invests in five or 10 people like you every year. And so there's two types.

[00:53:55] There's a type where you're going to sit together. And as you're part of kind of a little class and you kind of [00:54:00] can help each other a little bit. So that's another model. And so then the people who have more experience either do the self-funded because they can fund themselves, and hence they can typically, keep more of the equity on the back of that. Or what they sometimes do is they go to work for a private equity firm. They reach out to a private equity firm and they area where they have expertise. I'm making this up, I'm having expertise in biotech, so let me work for you as a private equity firm who works, who invests in that. You just pay me salary, you give me access to your due diligence.

[00:54:27] And when I find a company, in this space, I'll run it. And hence it gives you the advantage that, when I find a company that you like, because you ultimately will take the final decision. You don't have to solve the CEO issue. So there's different models out there, which might also be worth looking at for the people who say like, I want to acquire a company. I want to be CEO. Now there's the best part to rent to get there, for me.

[00:54:50] Ron Skelton: Awesome. Awesome. Well, I want to thank you for being here. I want to remind everybody that your book is available. I just seen it on Amazon, so I know it's available there. And it's called The Search [00:55:00] Funds and Entrepreneurial Acquisitions.

[00:55:02] And it's authored by you, Jan Simon. I want to thank you for being here. Is there anything you wanna say? Anything, if somebody wants to reach out and, show you a ppm or reach out to you, how would they go about reaching out to you? What's the best way to, to introduce what they're doing, to you?

[00:55:16] Jan Simon: Yeah, the easiest way is just connecting me to LinkedIn, send me a message and I'll take it from there.

[00:55:22] Ron Skelton: I'll make sure that's on the show notes through your LinkedIn, link. So we'll put that there. Thank you for being on here and hanging out for just a second after it. And that's the show, guys.

[00:55:29] Jan Simon: Great. Thanks a lot.