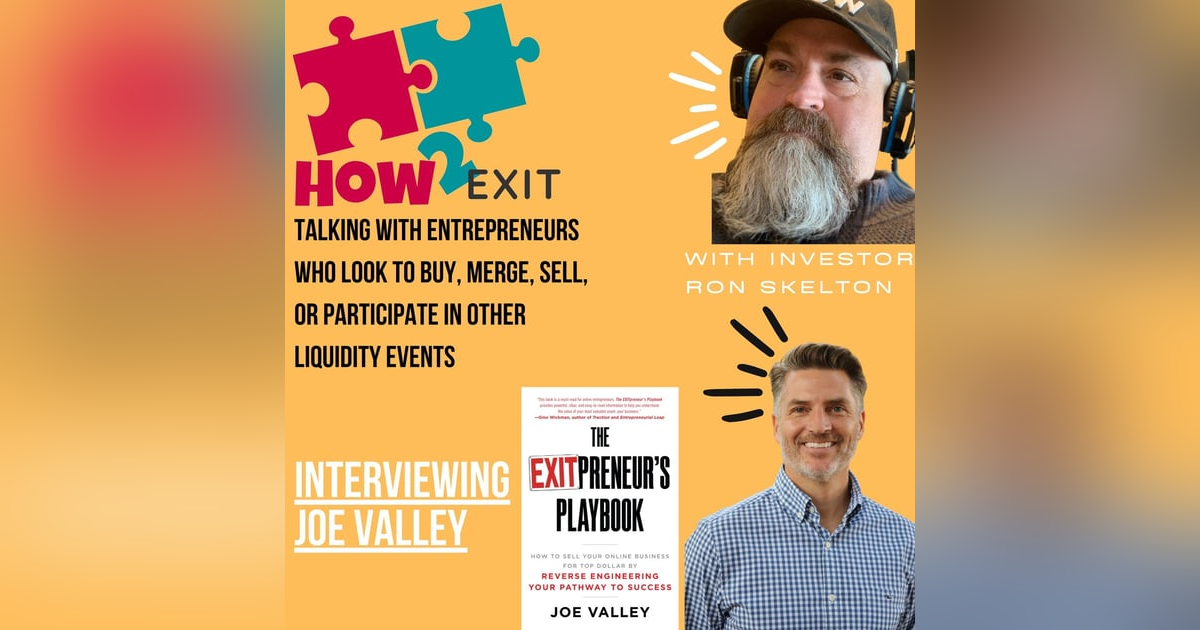

How2Exit Episode 17: Joe Valley - Certified Mergers and Acquisitions Professional.

After building, buying, or selling a 1⁄2 dozen of his own companies, Joe Valley helped build one of the leading online-focused M&A Advisory firms in the world. Now, after facilitating nearly 1⁄2 billion in exits, Joe has written the bestselling book...

After building, buying, or selling a 1⁄2 dozen of his own companies, Joe Valley helped build one of the leading online-focused M&A Advisory firms in the world. Now, after facilitating nearly 1⁄2 billion in exits, Joe has written the bestselling book The EXITpreneur’s Playbook - to help online business owners get the maximum value and best deal structure when they seek their own incredible exit.

Over the last nine years, Joe has mentored thousands of online entrepreneurs whose goal is to achieve their own eventual exit. He is a Certified Mergers & Acquisitions Professional, and a frequent guest expert in mastermind groups, on podcasts, and at events for entrepreneurs worldwide.

Joe's book, The EXITpreneur’s Playbook - How to Sell Your Online Business for Top Dollar - shares real-life stories of successful and failed exits, and teaches readers how to reverse engineer a pathway to their own eventual exit.

Before joining the team in 2012, Joe sold his own business through Quiet Light. Joe is a Bestselling Author, Guest Speaker, Podcaster, EXITpreneur, Advisor, and Partner at Quiet Light Brokerage.

--------------------------------------------------

Contact Joe on

Linked: linkedin.com/in/thejoevalley

Website: quietlight.com

Get a free copy of Joe's EXITPreneur's Playbook!: https://exitpreneur.io/how2exit/

Book: https://read.amazon.com/kp/embed?asin=B094DRTJZ8&preview=newtab&linkCode=kpe&ref_=cm_sw_r_kb_dp_5CV4DQ4GWWF7KT9PGVHN&tag=how2exit-20

As an Amazon Associate, I earn from qualifying purchases. Each purchase supports both the author and this podcast.

If you’d like additional ways to support this podcast, you can become a patron here: https://www.patreon.com/bePatron?u=66340956

--------------------------------------------------

--------------------------------------------------

Reach me to sell me your business, be on my podcast or just share some love:

Linkedin: https://www.linkedin.com/in/ronskelton/

Twitter: https://twitter.com/ronaldskelton

Facebook: https://www.facebook.com/How2Exit

Have suggestions, comments, or want to tell us about a business for sale call our hotline and leave a message: 918-641-4150

--------------------------------------------------

--------------------------------------------------

Listen to it on

Spreaker: https://www.spreaker.com/episode/48749292

Apple Podcast: https://podcasts.apple.com/us/podcast/how2exit-episode-17-joe-valley-certified-mergers-and/id1561038705?i=1000551277154

Spotify: https://open.spotify.com/episode/15m9tmMXjwga6WhljVCuKx?si=DqgaDGMrTLak0-ygGWWItQ

--------------------------------------------------

--------------------------------------------------

Other interviews:

Lana Coronado: https://youtu.be/6pxWPbDvMb8

Ali Tarafdar and Brucker Krafft from Labruta Capital: https://youtu.be/q_XGvUujdVM

Rudy Upshaw:

Ronald P. Skelton - Host -

Reach me to sell me your business, connect for a JV or other business use LinkedIn:

Ronald Skelton: https://www.linkedin.com/in/ronskelton

Have suggestions, comments, or want to tell us about a business for sale,

call reach me on LinkedIn: https://www.linkedin.com/in/ronskelton/

Ronald Skelton 0:06

Hello and welcome to the how to exit podcast where we introduce you to a world of small to medium business acquisitions and mergers. We interview business owners, industry leaders, authors, mentors and other influencers with the sole intent to share with you what it looks like to buy or sell a business. Let's get rolling.

Hello, and welcome to how to exit. I'm here today with Joe Valley. Joe Valley is a serial entrepreneur, it looks like you've after building and buying or selling a half dozen of his own companies, he helped create quiet light brokerage, one of the leading online focused m&a advisory firms in the world. Now, after facilitating over a half billion and exits, Joe has written a best selling book, the Exitpreneurs Playbook. To help online businesses owners get the maximum value and the best deal structure when they seek to their own business. Sorry, when they seek their own incredible exit. So thank you, Joe. Sorry, I I fumbled there I've been doing that a little bit lately. So now you'll know it's live organic, raw, uncut. And thank you for being on my show, man.

Joe Valley 1:22

Now, thanks for having me Ron. That's a mouthful. Look, every time somebody says Exitpreneur for the very first time they stumble over it. It's a funny story. You know, when I was writing the book, and in the process of coming up with a title, I reached out to a dozen friends and influencers in the E commerce world. And I said, Hey, I've got two titles for the book. I've got the I've got originally it was just Exitpreneur, and the other title was incredible exits. 90% of those folks that incredible exits all day long, Joe, it just flows from the telling, it just makes total sense. Of course, like an idiot, I chose the other one, and added the playbook to it because it is really a playbook for both people that are selling their online business and acquisition entrepreneurs that want to buy one if they want to see the other team's playbook.

Ronald Skelton 2:07

That's awesome. So one of the places I like to start is for our audience to get to know who you are and what you're up to. So can you tell us kind of how did you get started from whatever avenue you came up through the ranks here, you know, buying and selling your own businesses up until right in the book. And now it sounds like you're a founder of a successful brokerage.

Joe Valley 2:27

Yeah, I'm an entrepreneur. First and foremost, I've been fully self employed since 1997. But started, you know, dabbling in that all the way back to my childhood. And even through college. I started a restaurant delivery business called the wrong number I was imbibing in something when I created the name Ron just put it that way. I tell my kids I was an original DoorDasher, that company survive six months. And then I went to work for another company that eventually was bought by Grub Hub. So I know it's not DoorDash. But grub Hopper sounds so much worse than your DoorDasher. But in my in my adult life, I became fully self employed 100% self employed in 1997. And I resigned from my previous company company called Talk America, that was a direct response marketing company. Probably just before I would have gotten fired, to be honest with you, but that's the life of an entrepreneur, right? You can only get so far before you speak up too much and have other ideas and the boss wants to kick you out the door

Ronald Skelton 3:32

I make a horrible employee.

Joe Valley 3:35

I was interviewed the other day by somebody who was a career waitress and turned entrepreneur and I'm like, good for you, man. That's a hard job. I got fired from every waiting job I ever had. Sometimes intentionally though, but I became fully self employed 1997. My goal was to make $50,000 in 1998, because I've made about that much in 97. And I 10 times that goal and thought, full time entrepreneurships pretty damn good. Now, when I started that company, a company called JVI media, media buying agency, I worked full time in another job that I took at a call center while running my media, buying agencies full time as well. So I was working, you know, 80 to 100 hours a week, until I could just, you know, just focus on the business. That led to the first product launch in 1998, where I owned a brand essentially, and I didn't own radio and eventually television. And yes, I had a website that I built for 50 bucks, but it wasn't really a web site. Business wasn't a web based business. We just had trickle sales on it. That ran its course as many direct response marketing products do back in the day radio and television. And then I launched another one in 2002. And that one I took 100% online in 2005. I did radio I did television, but I took 100% online in 2005 got rid of all the pain points in my life. Because I'd promoted myself to my level of incompetence, and that's managing lots of people, I let them all go, except for one person, and brought my office into my home and had that person come to my home every day. And I built that online business up from 2005, through the best of the worst of the economy came out the other end, in 2010. Just tired Ron, worn out tired, emotionally worn down, the business was doing well, it survived the downturn in the economy was coming back. But I woke up one day and said, I gotta sell this thing. And it never occurred to me to build the business to sell until that day, which is just idiotic, because the agency that I built and launched in 1997, at one time, was doing more than a million dollars in discretionary earnings. And I didn't think it was sellable. It was job always business. You know, I had lots of staff, I was replaceable, but I had such an ego I didn't think I was, so I eventually just let that die on the vine fade away. So anyway, I I reached out in early 2010, when I decided to sell my business to any online brokers that I could find. And there were three. At the time, two were kind of reaching through their phone to get their hooks into me for a commission and it felt pretty awful, and the third, gave me some great advice after a second phone call with him. And he, he reviewed my P&L's, we went through the addback schedule, he educated me taught me things and then he said, You know what, Joe, if you wait another six months, you're gonna make another 100 grand easily because the the numbers are coming back up after the downturn in the economy. Basically, he told me to go away, because it was in my best interest, not his. Really, it was in his because I was hooked. I thought this guy is awesome. So it was it was guy named Mark dowsed, who's the original founder of quiet light brokerage. Now from that I'm a partner in well, I ended up listing the business six months later, with quiet light, joined the company, after taking a year off. So I joined in early 2012, when it was just mark, and Jason, who was my broker in 2010. And then shortly after that, Amanda joined, and that became my focus in my passion. I'd already built, bought and sold a half dozen of my own company has been very successful as an entrepreneur. And at this point, I wanted to focus on helping others not wake up and decide to sell their business, but actually take the time to prepare to sell their business. And since then, I've had over a thousand one on one conversations with entrepreneurs I've so personally sold about 100 million in transactions helped facilitate another half a billion through quiet light. And if we look back from 2012, the average deal size Ron might have been 125,000. When it was just me, John, me, Jason and Amanda. In 2021, the median deal size was 1.8 million, we closed just under 250 million in total transactions last year. And we've got a total of 15 advisors on the team now that are all entrepreneurs turned advisors.

Ronald Skelton 7:56

That's awesome. So it is a heck of a journey. And now you've got a book out to help others to so somebody can start with a book, go through that tell us about what's in the book. So you know, those those of you out there who are thinking about exit in you have a software company or an online business? What what's the value point inside of the book that will help them prepare for a better exit,

Joe Valley 8:17

it's everything you need to know to understand what brings value what plummets value, how valuations are done, what buyers want, there's the four pillars of value in there that are not, it's not math and logic, it's all you know, things that will sway your multiple high or low in a multiple range. It's it's all the bits and pieces of water cooler talk corrected into accurate information, all the little different websites and blogs that you need to go to and people that you talk to the Exeter their businesses, it's all in one place, it's corrected, and it's accurate, and it takes you through the entire process. And it sort of demystifies the process of you know, preparing your business to sell for maximum value to a great buyer at a great price and in with terms that allow you to sleep at night, hopefully mostly cash but and kind of honestly dispels the myth of you can, you can do this on your own and you don't need to figure out what you know, an add back schedule is because if you don't do a proper add back schedule, I can pretty much guarantee you're gonna lose 10s of 1000s of dollars in the sale of your salary business easily, easily.

Ronald Skelton 9:29

A lot of people don't understand what you're referring to but an add back schedule is all the stuff that you use, you know, some people call it in using the business as a lifestyle business or whatever, but it's all the things that use us that you know, you use on to fund your personal like you're everything from I've seen car leases, I've seen cell phone coverages. I've seen somebody had all these Netflix, Netflix accounts and everything else on there, the little thing but there's some bigger stuff that's in there too, that you know people Joe fell to add back. And you know, that really makes an impact most of us are, you're buying on a multiple of sellers, discretionary earnings or EBIT. So if you don't put those numbers back in there, you don't get that multiple, you're not losing $1 for dollar, you're losing as much as you know, $3 For every dollar you don't add back in, or maybe more if you've got a strategic purchase with the right guy. Right? Yeah, I'd

Joe Valley 10:24

say I'd say anywhere from two to seven times, if you're looking at the, you know, multiple ranges of what we sold last year. And it's it's, it's good, it's not EBITA, it's, people would say it's maybe adjusted EBITA. And the true definition of an add back is a one time expense, or an owner benefit. Well, let's reverse that an owner benefit or a one time expense that does not carry forward to the new owner. Let me give you an example. A couple of dramatically different examples. Number one, if you own an E commerce business, with the majority being an FBA business, and you've been reached out to by an aggregator and that aggregator says, in a very charming, likable, well funded, incredibly passionate way that makes you love them. Hey, man, we love your business. We pay all cash close in 30 days, avoid the broker fee. If it sounds too good to be true, probably yes. But they you're selling directly to an aggregator. If you own an FBA business, you probably subscribe to Jungle Scout, you probably subscribe to Helium 10. That's 500 bucks a month right there. They already subscribed to those. So that is an expense that will not carry forward that $6,000 a year if they're paying you a three time multiple. That's $18,000 in your pocket. I cover 18 additional add backs in the book. That's not even in the book. I didn't even realize that until I was on a live stream, LinkedIn live stream with one of the founders of one of these top five aggregators. It was an awkward conversation because I had to bring that up. He's like, Yeah, no, you're right. Another extreme example would be I was at a eight figure event for eight figure sellers in October, sitting around a fire pit with one of the guys who's telling me he has a substantial offering his business, you know, $50 million. And I said, Okay, well, did you, you know, tell me about your p&l, presentation, preparation, and add backs and things of that nature. And he kind of went blank, even though he's doing, you know, multiple 898 figures, he didn't know what an ad BAC was. Okay, so you don't have to be huge to be perfect and understand all this or just because you're small doesn't mean that you should know this. He does $50,000 a month in cash back money. Cash, Mac money, you know, everybody knows what it is. And in his case, and in probably 90% of the p&l is I look at that money just slides over to people's personal account, and never hits the p&l. It's a discount on advertising, it should hit your p&l, it's the the end results are the same. But he does credit card stacking. So we could get that much that's $600,000 a year in cash back that was not on the p&l, his multiple that he was offered for his business was 10 times that $6 million added to the list price of it, because he bought the beer for me that night and will buy many, many more over the lifetime. But a lot of their add a subtract zeros, it doesn't matter. There's so many nuances to it, that you've really got to dig into it. And we won't go too far into the weeds. But understanding those things in a simple logical way, as if we're sitting around, you know, across the table, from each other at a at a bar at a pub. That's what's in the book and trying to get it away and across in a simple manner that people understand and can refer back to whenever they want to.

Ronald Skelton 13:41

What you brought up is kind of interesting in the fact that I hadn't seen that level of add backs because I don't do right now I'm not into buying the software side of things. And I don't see a lot of the, like the online side of things, a lot of the stuff I'm looking at is brick and mortar. But it the point that it brings up to me is every industry has its own nuances. And to find, you know, a broker or an advisor that understands that industry, and what's there what's normal, and what should be added back and all the different things and the ins and outs of that industry could could net you quite a bit of difference. In your end. You know, you're in deal. I'm sitting here in Tulsa, Oklahoma. And I would imagine, I know I've got two friends here that are brokers. I would imagine if we put the deal in for the same deal that you just talked about in front of both of them. We'd have three different numbers, right, as to what would be the endgame.

Joe Valley 14:37

Yeah, it it has to be addressed with math and logic. First and foremost, you can't do any gray stuff in there because that erodes trust, right and when you erode trust, the deal that you're going to get the offer you're going to get is going to get diminished and reduced. You may get the same value but it's going to be with there urn out or something like that because they don't trust you anymore. But there's there's there's How many different add backs that I mean, even a website redesign is at the very least a partial add back if you don't do it every year. If you do it every five years, I'd say it's 100%. Add back, if you do it every year, it's not an add back math and logic, simple as that. But you got to understand you got to know what to look for. And you got to take the time to do it, before you start negotiating with your buyer. Or it's really important as an acquisition entrepreneur, to understand these so that when you look at a p&l, and somebody wants a four time multiple of their net income, and haven't done any setbacks, and you go, okay, their salary is 100,000. They didn't add that back. You know, this that the other thing? Really, this is a two and a half time multiple. Yes, sir, I'll pay full price for your business, because you're getting, you know, what I call an ignorant ignorance discount when you're buying the business because they didn't do an epic sched.

Ronald Skelton 15:47

Right. So one of the things I I'm always curious about if you've been doing this for quite a while, right? So what's one thing you know, now you wish you'd have known at the beginning of your career, like, what's one key takeaway? Maybe it's in your book or whatever. But like, what's your key takeaway that you wish you'd known when you were selling your companies?

Joe Valley 16:07

The reality is that historically, as entrepreneurs, we've been told, we should always have the end in mind, when we start our business, we should, we should be planning our exit. And I find that for the first time entrepreneur, slash exit printer, if that's the path, they're going to go down, it's complete Nutter bowl, because all, all you got to do is try to keep the wheels on the bus man, right, you're just trying to make sure there's enough cash flow to stay alive. But at some point, 612 months, you know it along that road, you got, that's when you've got to reach out, read the book, reach out to an advisor, that will give you a true and honest evaluation with no Hawks. That's what the m&a visors do in the online world, do that don't wake up and decide to sell your business like I did, even though I waited six months, if I had known that I was building a business that I could exit helmet, I would have sold the first one for a hell of a lot of money. And the last one that I sold, that ecommerce business that I sold through quiet light back in the day, I would have sold it a lot a lot earlier, where I would have pushed and pulled certain levers that would have increased the buyers confidence. Those are the intangible things that can can make an enormous difference when it comes to the deal value and deal structure that you get.

Ronald Skelton 17:38

So I'm on the buyer side, in your mind, I kind of have my idea what what increases buyer's confidence. But from your perspective, you've seen way more deals than I have. Right. I've been in this for two years now. And so from what your perspective, what are the key elements to induce confidence, you know, in a buyer, you know, the

Joe Valley 18:00

Yeah, yeah, there's, there's really four things that buyers have consistently looked at, there's sort of four, four categories. And keep asking questions over the last, you know, 15 years that we've been doing this, and it evolves around risk, growth, transferability, and documentation, let's jump to the last one. If you don't have financials, you can't get out of the starting gate with a valuation. So just knock it off, grow up, hire an E commerce bookkeeper, outsource it's less than a car lease, they'll do the p&l, they'll do everything for you. And then once a month, you can analyze it, and improve the key metrics of your business to financial key metrics. So documentation is pretty critical. Let's go to number three transferability, it should go without saying that if the assets that drive the revenue of the business are not transferable, you do not have a sellable business. There's some challenges in some cases, if you are the name and face of the business, it's still transferable, but it's not as clean, you have to stick around for a while, you'll get out of the daily grind of ordering inventory and doing this and managing people but you'll still have to be the name and face because that's who the customer knows. So that transferability gets a little trickier. Growth. Number two, really important that you're selling the business when it's growing. Because if it's been growing, and then it flattens, and then declines just for a couple of months, compared to the same time last year buyers gonna go, Whoa, I'm gonna project this out 12 months and your four time multiple is going to really be you know, a six, nine multiple because the trends are down. When you get into growth buyers love built in paths to growth, right. So you're buying a business from me Iran, I have 16 skews. But I launched seven of them in the last 12 months. And you know, they're not fully 12 months old. Some are ones and three, some are six, and they're already generating 30% of the total revenue. That's awesome. You love that. because it's a built in path to growth isn't just going to grow and mature and all I have to do is let that happen. Clear growth opportunities really critical to buyers as well. If I have 16 skews, is that the most I can possibly have with my brand? If I tapped it out? Or are there skew expansions are there platform expansions or the country expansions, things of that nature gotta have that, if we go on to risk, really risk is huge, right? It may be in the form of the age of the business, the younger the business, it is, the higher the risk, the higher the risk, the lower the multiple, a lot of buyers will come in first time and say, you know, I don't want to risk a whole lot of money, so I'm just gonna buy something small. Well, the smaller businesses are actually a little less established. They don't have a wide balance of skews, they don't have a wide customer base, they don't have recurring revenue or repeat revenue. And they are actually riskier, buying a $3 million business that's well established been around for five years is much less risky, or less risk than buying a two year old business that's doing $400,000 in revenue. Okay. Very important. Fear of obsolescence huge, huge if you're selling a electronic device that you know needs to be updated or remodeled every year, I sold a a electronics charging station a few years ago company is 70% of their revenue was from this, this charging station where everything had to be plugged in fear of obsolescence all the buyers thought everything's going wireless, we're not going to have cords and plugs anymore. Total fear of obsolescence. Couple that with the fact that 70% of the revenue came from a single SKU, that's a hero SKU. These are all risk factors that will plummet the multiple range and cause a buyer to say, Yeah, I'll give you X amount of cash, but the rest I need on an arena.

Ronald Skelton 21:57

So what are the things I'm concerned with the online stuff, and I have a background in websites and online stuff. But when I what I'm looking for right now, when I've referred to as the boring businesses, Pest Control, Home construction, that type of stuff, but I wouldn't be opposed to it. But one of the biggest concerns I'd have for like a Facebook's I mean, a Facebook, a amazon store or something like that, is there one decision away from being cut off? Like, you know, Amazon could make one decision. And, you know, critically hurt, you know, quite a few of those they did, it was a while back on their affiliate program. And I know some people that were making some really good money doing review sites like audio review, and they're doing really good. And then Amazon one day said, You know what, we're not going to give you I forgot what it was 8% or something crazy 10% We're gonna do one or two, they just dropped it. Like, it pretty much killed their businesses. So my concern in that space would if I were to look at something that had a few skews, maybe a dozen skews or something, I want to see that there really dominate Amazon because that's the big gorilla in the jungle, right? But I'd also want to see that they understood well, it could run well on, say, Spotify, or I don't know, if he Bay's even a player anymore, I'm kind of dating myself or, you know, one of the other channels, but they have other channels have something changed, they wouldn't die, they could actually shift and still you'll push more market into one of the other channels and still sell stuff. Is that an irrational concern? Or what would you say on that?

Joe Valley 23:25

You know, years ago, there was a huge fear and concern about FBA business. And let's just call that one, you know, any e commerce business, it's doing 75% of its revenue on Amazon. Okay, it may have its own Shopify store and you know, other channels, but 75% coming from Amazon, that is essentially an FBA business. Huge fear there. People thought, the sky is falling, Jeff is gonna just take it all over, he's gonna own all the brands and just sell on his all his own stuff. I always thought that was kind of silly, right? And now we have people that are smarter probably than you and I incredibly well funded risk averse, that have raised billions of dollars to do exactly what to five years ago, people were afraid of all they're doing is buying Amazon based businesses, and putting them into a portfolio when the value becomes huge. So I think that there are risking in some categories. Right? So these aggregators for the most part, they won't buy electronic devices with big fear of obsolescence. They probably won't buy clothing businesses, because the vast amount of inventory that you have to have shoes and things of that nature, they don't they stay away from certain categories. They're not buying affiliate businesses because they see that just like that you can go from 10% to 4%. At a business under LOI. When that happened, actually it was I was just listing it when it happened. And we had to go back into the ad back schedule and make an ad adjustment for that change going all the way back, it's just the reality of it, the business was worth less. So there's a legitimate fear at a certain level there. But then you've got to go rational and go, Okay, well, these guys have raised billions of dollars. Amazon is a publicly traded company, they're not just going to come in and change everything, because it's gonna hurt the stock price and stock prices is most important.

Ronald Skelton 24:22

So I get that. The reason that's the risk is lower as it's a mature market now, right. Those Amazon retailers make a significant portion of Amazon's money. Yeah. You know, it's I think that's, you know, I can see that, you know, I, I don't know that maybe it's just an irrational fear of, you know, the unknown, what do they call that the FUD fear of the fear of

Joe Valley 25:50

What is, you talking about FOMO?

Ronald Skelton 25:53

fear, that's fear of missing out. There's another one, it's like Fudd, or something like that? fear, uncertainty and doubt, right? You know, the, the fear, uncertainty and doubt about Amazon, being able to pull the rug out from underneath, something you just acquired, has me hesitant on it, but I get it, if you know that space, you're in you're proficient at it that goes away, just like anything else. You can remember remove fear, uncertainty and doubt with the proper amount of training and experience.

Joe Valley 26:19

Yeah. And on Amazon, obviously, review count is critically important. You want to get into that Amazon account and see what sort of warnings it's gotten over the years. You know, if it's defensible, does it have a trademark? Does it have a utility, patent design, patent things of that nature? And is Amazon selling, you know, in the same category, Chinese seller knockoffs, right, this is the next big sweep, Amazon's already starting to do it and shutting that down. You know, originally, it was review manipulation, that still happens, but it's much harder. And eventually, they're going to fix this, you know, you know, cheap knockoff bogus review stuff. And it's going to get a safer and safer marketplace to build a brand, I think over the years.

Ronald Skelton 27:03

So to, to share one of my own faults, what are the only things one of the things I fail that I actually used to flip websites just like, you know, I've got a real estate background, we flipped houses, we buy and sell houses. But I would flip, I'd find websites, back then, you know, the micro acquire and I forgot the other one off the top of my head Flippa. They didn't exist, right. But we had these Warrior Forum forums and stuff where guys like me who were building sites and ecommerce tools out and stuff like that would go on there, we'd help each other we do some development for each other's projects and stuff. And occasionally, somebody go, Hey, I'd really like to sell this. And there was a marketplace inside of that. So I would buy ecommerce sites back when you could put $1 into, you know, Google Adsense and get $10 out, you know, it's just like, free printing money. We'll buy these Yeah, that now it's competitive, competitive. But uh, no, I would buy these things. And you know, just cleaned them up to a better website, have my team, redo them, get the numbers up and sell them because they're just like everything else that sold out a multiple, my problem I ran into back then was the guys out there selling the websites got really good at faking their profiles, meaning that like their PayPal accounts, they're all this stuff that was, you know, that you would look at to evaluate the price a lot. It was faked. And, you know, I bought one I won't even say it was it was five figures. It wasn't even in the six figure realm expected to turn it around. And within days of buying it, ran it and figured out that all their traffic was bought, right, they didn't disclose. And they were it was largely they were paying so much for traffic, that it just wasn't making money. Right.

Joe Valley 28:54

They're wasted. defend against that. Now back, back then there wasn't and, you know, there's a number of different due diligence firms specializing in the online space, the one that comes to mind is central Rika, c e and t u r ica.com. They are a company that will verify all of the financials to do live screenshare still require access to, you know, third party information. And look, we all make mistakes. That's the life of an entrepreneur. You know, I said I took 2011 off, which I did, but what I was doing in that time was trying to find a business to buy, and I bought one, and I think I closed March 1 2012. And I had 42 glorious days. 42 glorious days. And then the Penguin update hit and six, you know, ranking six listings on page one went to page two, three and four and I lost, you know, over $250,000 Talk about about punchiness. stomach, right? That's part of a little life of an entrepreneur, we get excited about carry forward loss losses on our tax returns. There's, there's companies that can help you with that. And if you're buying a $50,000 business, or 500, or $5 million business, do the smart thing, I guarantee you that $5 million buyer is going to have a company to do due diligence for them. If if somebody is using an SBA loan, to buy a business, through multiple levels of due diligence, they hire a third party valuation company, they do their own due diligence, you should you should be doing your due diligence, it's your money you worked hard for protect it. But we do make stupid mistakes, because we're entrepreneurs, and we think we can do anything.

Ronald Skelton 30:40

So you mentioned a couple of resources out there, what are the best resources you can think of that have helped you along the way that are still out there that people should look at in this space?

Joe Valley 30:50

You know, honestly, I'm not a very tech oriented person, you are more so than me. And I think the resource that you can best utilize is understanding who you are as a person. And make sure you don't promote yourself to your own level of incompetence, right. And really, really don't get shiny object syndrome, like we all do. Don't say I can do that, when really you should be doing something else. So we were talking about Cody Sanchez, before we hit record, Cody owns 26 businesses. She's all about acquisition entrepreneurship, and those unsexy businesses, right vending machines, car washes, things of that nature. I own one business now, well, technically two, because the book is a separate LLC, but my focus is quiet light, and building that brand and reputation and helping people understand the value of their businesses. And it's because I understand my own level of incompetence. I'm not tech savvy, we have a CTO, I cannot do run seven different companies at once. I'm not really good at delegating, getting better at it with age. But the best resource you can do is figure out who you are, and what you're good at what you like to do, what you are, okay, this is part of life, I'll do it and then what you love. And if your business is all about what you love, then put somebody else in place to do it, or get rid of it altogether. So I think the first place to look is internal, not external.

Ronald Skelton 32:16

It is really important people get that message. It comes up in almost every podcast that we talk. Almost everybody I interviewed talks about knowing who you are, what your skill set is and who you need. And I always I should probably get an I should probably get an affiliate program from fans all of it. I always promote his book. Dan Sullivan has a book out called who not how, and maybe in a minute, when you're when you're in deep conversation, I might reach up and grab it off my bookshelf. I don't see it right away. But uh, it's really the beauty of that book is a lot of times if you're trying to figure out how to do something, and I got my air quotes off the screen. If you're trying to figure out how to do something, you're very likely not the right who to be doing it in the first place.

Joe Valley 32:59

Yeah, we we've the executives on the I guess the executive team have quite like now has all read it because we're part of a internal growth program. Like, hold on, I'm gonna grab a book, right? Yeah, you know, Gina, Gina Whitman is on the cover. And Jean is the founder of Eos. So we're in an EOS type program. And we've all read who not how. And for us, what it's done is, you know, we needed someone to be the point person for all these aggregators that are hitting us up with, you know, requesting information and telling us their full story. And, you know, in 2021, only 30% of our transactions were with aggregators, but they make a lot of noise. So we need to put somebody in charge of that. There's a woman that came on board acquired Deanna Bharati, she is that who not how she figured it all out, she was just a person that needed to be on our team, because she could do so many different things and tackled so many different things. And lo and behold, because we picked a who she's now on to the next big project already, and doing something that we've needed to change for five years, our lead distribution program, and DNS tackle that because she's the right who she's that right person on the bus, instead of, you know, me trying to figure it out and painfully piecing it together with VAs and things of that nature. So I'm on board with that 100%

Ronald Skelton 34:21

As far as I've built websites and stuff, and I know I'm not the WHO for But occasionally, it's like, I'll just jump in there, do it myself, and then realize I can spin 810 12 hours, maybe 3040 50 hours depending on the complexity of setting up a WordPress and all the plugins and getting it right. And it still won't be as good as you know, somebody I could pay, let's just say sub two grand even like 1500 1800 bucks, it would dominate anything I could come up with and I just wasted a week of my time. Right? And on a given day, if I don't make more than a week I've really messed up. So, you know, I'm a big fan of that. So it's funny that it comes up in every single interview But it's critical to know who you have on your team who you need on your team and constantly be on the lookout for people going, hey, we'll figure out how, right? Because often when you say, hey, we need to figure out how to do this, it's like we the, the phrase should be, hey, we need to figure out who can do this better than us. Right? I agree. Yeah. So I appreciate everything we've talked about so far, I'm really kind of, you know, really liked the concept of the extra extra printer. I still put you're in the Dave there. I'll get it by the end of the podcast, I'm sure I will. Um, you mentioned a few other books, you know, when we started, they're going back to the, you know, the resource side? Are there any mentors out there, or anybody out there that if somebody and maybe even you guys have a program, somebody's got an E commerce thing, and they're like, I'm gonna build this thing. And I'm not building this to be a lifestyle business and run it for 20 years, I want to build it, grow it, sell it and go build something else there are there are entrepreneurs who will love that creation space that build space? Who could they reach out to that help them might get to the process to where it's truly sellable at maximum value? Is that Is that something you guys do? Or is that

Joe Valley 36:12

exactly what we do at quiet light. And so there's a couple of steps I would take. Before doing that, first, I would set some goals, right. And not I want to sell my business for a million dollars. That's a wish that's not a goal, I would get very specific and something like with with in the book, I talk about dollars, date and feelings. So I will sell my business for $5 million in the third quarter of 2024. And when I do run, I'm going to feel just incredible, because I'm going to be out of debt. And I'm going to get spend more time with my family and take that two month RV trip we have always talked about that emotional part will help you get over what you and I and everybody listening that's an entrepreneur know happens, which is those bad days, weeks and months that we have as entrepreneurs. So set that goal, be very specific about it. And then just like, if you put into Google maps that you know I'm in, I'm in Charlotte, North Carolina, if I want to go to Boise, Idaho, I know I can go north, on 77, left, west on I 40. And eventually get my way there and figure it out. But it's not the most direct route, if Google doesn't know where I am now. So you got to reverse engineer a path to where you are, in comparison to your goals. That's a valuation, firm up your valuation, you get pretty close with a book. But what you're missing are the actual close transaction data. Right? You might be able to do a pretty good job with your add backs and your schedule and figuring out what your sellers discretionary earnings are, I give valuation ranges in the book, but those change as times change, right? They've gone up a lot in 2021. But reverse engineer a pathway to those goals by getting a firm valuation. And the advisors acquire LIDAR just like Mark was for me helpful. First and foremost, we're not salespeople. They're just entrepreneurs helping entrepreneurs. We, I have a personal mentor that I talked about on many podcasts, and I think I mentioned him in the book. It's Uncle Walter. Okay. It's actually my wife's uncle, a very successful entrepreneur that's now fully retired and plays lots of golf down in Florida, when I was becoming a partner at kweilyn, and I talked about the business model with Walker with Walter, you know, I said, Well, you know, we, we do these valuations and we help him we coach and we guide, we tell them, what levers to push and pull to make it more valuable to buyers and we firm up their numbers. And then we just, you know, wait and see when they're ready, they'll come back to us. And he said, Well, Joe, it sounds like you were just giving everything all away for free and just hoping that they'll come back. I'm like, Yes, Walter, that's exactly the process. And it's worked for 15 years. It's what Mark did for me, he helped me and because of that I didn't really want to work with anyone else. He built trust in May. Anybody that is overinflating over promising under delivering on multiples and all this other stuff. Just trust your gut and move on to the next one to get evaluation by a professional and then you know how close or how far you are to those goals and then touch base with each other on a regular basis just with an update. Simple as that. No no commitments no engagement letter no nothing.

Ronald Skelton 39:18

It's interesting as I've had probably a half dozen brokers on my podcast and after the first one who happens to be a friend of mine but he was really new into it. I real and I I've actually talked to probably 30 on top of the half dozen dozen I've had in on the podcast, who wanted to be but I'm a little biased I did my research on you I actually looked at your your model online what you said on your website and stuff in it appealed to me that reverse engineer and the fact that you are willing to work with people and help them maximize that is critical. There are so many brokers out there who I'm not trying to butcher brokers by any means, but the point I want to make is they're not all equal. And they're there's bad actors in every space. And there's a lot of brokers out there that are making the majority of their money not helping you sell your business and maximizing what you get. But by charging you a listing fee and getting, you know, a listing contract, and getting fees up front. And the scary thing is here in the United States, the industry statistics is something like 80 to 85% of all businesses ever listed by a broker never sell.

Joe Valley 40:28

Yeah, and funny enough 98% Of all the listings that we list sell. In fact, last year, we had 3.77 offers on every single listing 62% sold at or over asking price. We don't look at ourselves as brokers. In fact, we call ourselves advisors now in all facets of writing and communication. But more than anything else, Ron, we're entrepreneurs, we've been there, we've done that, and now we're helping. And so we are entrepreneurs, and educators who happen to be m&a advisors, as well. But that entrepreneur education comes first. Right? And then when you're ready, and I also say, eventual exit, right? Because I really want people to touch base a year in advance of when they want to have that exit, at least a year. And so when you're eventually ready to exit, hopefully, we've built a relationship where you understand the value that we bring, and you'll want to work with us. If you don't, that's okay.

Ronald Skelton 41:26

I get that. And, you know, going back to what I was saying before, there's, there's good and bad in everything. A lot of it is on the fact that in most states, I don't say most, I think there's less than a dozen states that actually require a broker's license to be a broker, and another dozen or so that you could have to have like a real estate license to be a business broker, because a lot of businesses are tied to real estate. But in both cases were like here in the Oklahoma, I have a buddy who who bought a brokerage. And you know, he said, Hey, if you want to be a business broker, just let me know, and I'll throw your name on a card. I was like, Hey, I'm really good at taking tests. I'm like, Okay, what kind of test? Do I need to take? Oh, you don't need test here? And I was like, how is that true? Right? You're talking about people's livelihoods? I was talking to one company last year that they've been running their business for 63 years. Can you imagine like, taking a company that's been running for 63 years, and I'm not gonna say his name or his brokerage, but go into a guy who just bought his brokerage to list your brokerage and has no experience in it whatsoever. Have some training from his franchise?

Joe Valley 42:27

Yeah, yeah. You know, titles are good. You know that, but they're just titles, right? So I'm a man without a title and quiet, like, Mark wants to have me be called president. He's the CEO. He's the original founder. I don't have the title. I kind of like it. I have I have a label on my card. I'm a surgeon in my signature line, I'm a certified mergers and acquisition specialist. Right. I've gone through the course. But honestly, Ron, it was relatively useless to what I do. Because I've already, you know, by the time I took the course, I'd sold $80 million in transaction. So I learned, you know, along the way, and we have a system in process. With that said, you, you don't shouldn't have an advisor selling your business that has never sold anything before, unless they've got a ton of support behind them. Like every transaction acquired light is not, you know, it's it's led by one person, but everybody, including myself and Mark are in support in the background. So you know, you're getting the collective collective experience of 15 advisors that have sold half a billion dollars in transactions. There is licensing nationwide, by the way for brokers, but it's for stockbrokers, it's FINRA compliant. These are 99% of them are asset sales, non stock sales. And when it comes to online businesses, most of its goodwill, least 80% 90%, some cases 99%. Goodwill, because everything is online, it's all virtual, there's no physical assets to the business, the laptop, the computer, the cell phone, that doesn't transfer with a sale. So it's it's a it's a it's a tricky business, and you just have to find a firm that has been at it long enough that you can connect with, you know, what the, you know, what the most important thing is, and this is where people make a huge mistake and don't do the work, right, both buyers and sellers. Look at the full packages that the firms put together. Now I am on lots of calls with, you know, people that are buying and selling. And I say well, have you looked at our listings? Oh, yeah, no, I look at them on a regular basis. Okay. I don't see you in the full. I don't see that you signed a nondisclosure agreement. Like, and they're like, you know, I look at them online all the time. Well, the online listing is just the teaser. You're not supposed to really figure out what the name of that business is. What you absolutely should do if you're risking 1000s of dollars of your hard earned money buying or selling is click on a listing from any brokerage firm m&a firm, fill out a nondisclosure agreement, sign it and get that full package. And then you can get all the other full packages as well and digest them. Look at the questions and answers that are being asked, you're not ready to talk to an advisor, you're gonna see all the questions and answers that we asked you a quiet light, pretty, pretty damn thorough. It's all there, it's an educational resource that you could use, maybe just take the time to do it. But based upon 10 years of conversations, most people don't do that. But it's a really smart thing to do. If you really are serious about buying or selling your business.

Ronald Skelton 45:28

I, I don't know if you approve of this. But I'd actually recommend that if you're going to sell your business, I would tell you to go to your broker look at similar businesses on on the brokerage, not competing competitors, because if they see that it'll be a problem. But just businesses in your genre and your space online businesses or, you know, maybe in a different market or something. But before you use your brokerage, I would venture to say, sign the NDA and look at what they put together for these other guys. I don't know how many times I've filled out something online to see, to see the full package and then really disappointed about what was sent to me as a full package. Right?

Joe Valley 46:05

Yeah, you're saying it in such a nice succinct way. That's exactly what I was saying. And the one thing that I'd add to that is that, don't let the advisor send you package links, because they're gonna cherry pick them, you go in, and you click on any of them that you want to look at. Well, ones that are listed by that advisor would make the most sense. But don't let them pick them for you, you go in and pick them without them choosing that way you see the work, all the work that they do.

Ronald Skelton 46:33

It's interesting, it's uh, I had one particular first package information I got from the guy was really great. I was like, Man, this broker is on top of his game, and then got into the, you know, discussions found out that I had to do you know, I had to move so fast on that one, it just wasn't gonna happen because they had somebody about to submit an LOI. Right? And they were, they were pretty far down the path. And I was just not even interested. I'm not even sure I wasn't totally interested in that industry. But it was a curiosity. So I was like, man, what else do you got? So I'm thinking I'm gonna work with this broker, man, he stuff was thorough, it didn't look. So a lot of times these guys had so much stuff. And you're like, Okay, there's a lot of BS inside of this stuff. This guy, it looked legit. The next two things he sent me were absolutely garbage. And then I found out after talking to them, I made friends with that business owner. And he did sell to that other guy, but I still, you know, chatted with him afterwards. And you know, what did you like? What did you not like and stuff, might even have him on the show. So that's why I'm not gonna say the brokerage name or anything. But, uh, sometimes I have businesses that exit on here. And my question to him is like, Well, he did such a great job on your package. You know, I don't understand why I didn't get anything cool from him and everybody else, because Oh, no, he didn't do ours, he gave us the list of what we needed. And I was so lost, I hired a third party marketing company that builds exit packages, and they did all the slide decks and everything and work with me, they had an accounting team that did all the, you know, the p&l and make sure they're right, they audited my books, they did everything that you know, you see, and they went through, he made 22 grand to have somebody else build that package to make his business marketable, and then paid the broker to put it on biz buy, sell, to sell it, and I just, I broke my heart, because I was like, you don't ever have to do that again. You know, you know.

Joe Valley 48:18

And the problem. The problem with that, for buyers of you know, of that brokerage firm is that when they look at a new listing every day, or every week, or whatever it is, they all look different, right? So we've taken the approach of trying to break down barriers and make it easier for people to make decisions. So you know, every p&l you'll ever look at is formatted differently, looks totally different. And so we import that p&l into our format in our system, so that if you're a buyer, and you look at quiet light listings every day, and we have launches, three to five times a week, now all those p&l is going to be pretty much formatted the same, you'll know I need to look at the key metrics tab to see how revenue is or discretionary earnings is as a percentage of revenue year over year, you can look at all the same stuff. The numbers are different, the guts of it is different, but it's formatted the same. Same with the packages. They're all packaged the same. We also, we also do and I think, as I'm saying this, I'm not I don't mean to be selling, you know, quiet light, because this is not rocket science. It's just hard work. One of the things that we implemented years ago, Ron was an interview recorded via Zoom video and audio of the seller of the business. So if you're, you know, selling your business would be just like this. I'd be asking you questions getting to know you, so that the buyers can see you see the whites of your eyes, see if they, you know, get a good vibe from you. If they trust you, if you showed up with a, you know, a Biden hat on our Trump hat on and you hate that person and then you know, like, okay, ruled out, I'm not gonna buy that business. It's not hard work. It's just, I mean, it's not it's not rocket science. It's the Hard work, you got to put the effort in, so that you make it as easy as possible as possible for the buyers to make decisions. And that shortens the listing timeframe as well, right? I think the average time last year from the moment it's listed to the money changing hands is 89 days or something like that. And that includes, you know, multiple eight figure listings that take, you know, longer as well. But it's not it's it's not rocket science. It's just hard work.

Ronald Skelton 50:29

So right now, there's a huge hot spot inside of the online business, the SAS, do you guys do a lot of the SAS type of businesses or just the stores and stuff?

Joe Valley 50:38

No, we absolutely do the SAS we do the majority of our transactions are still ecommerce meaning more than 50%. Right? It's probably more like 60%. And of that 60, probably more than 50 of that is FBA oriented. But the other 40% is a good mix of content and sass. And those portions are growing for sure. We're sponsoring micro comm now and a couple of other sizable SAS conferences. You know, we've got some folks that are just brilliant in the SAS space, David Newell, Chris Guthrie, folks like that, that know incredibly well, John Haynes daku sold the SAS business just joined our team as well.

Ronald Skelton 51:15

Awesome. Well, I want to make sure everybody knows how to get a get a hold of you. So I'm gonna put post up your LinkedIn at first. So here's the here's the LinkedIn, verify that with me, and so make sure I don't have to edit that. That looks right. Awesome. I should have done this before the podcast. Alright, so for those of you who are listening to the podcast, you can find him on LinkedIn. His LinkedIn is the standard LinkedIn URL, which is linkedin.com/in/the, Joe Valley. And I found him pretty easily just by Joe Valley, I thought that was a common enough name, it might be hard to find it was pretty easy to search for him on there. And the name of his company, I'm gonna show his URL. Next is quiet light brokerage. So when you're looking for Joe Valley on LinkedIn, you can easily go to quiet light brokerage calm that's also on the screen. For those of us I'll put both of those in the show notes in the description of the show so that you can reach out to Joe here.

Joe Valley 52:12

It's actually quiet light.com Now, but it will still redirect quiet light if you type in brokerage.

Ronald Skelton 52:18

Okay. So for those, let's see here. It should be this right. So just quietly that the brokerage officers what you did, right, yeah. So it's just

Joe Valley 52:30

I spelled it somebody wrong when I was typing it in over the years, we had to change

Ronald Skelton 52:33

it. Alright, so let's see that. The shorter the better. Is that right? That's it. Okay. So this is the correct one, if you're watching, if not, just go to quiet light, comm qu I, et li GH t.com. And those will be in the show notes. Do you have any parting like tips or wisdom you'd like to share with everybody before we wrap up the show or

Joe Valley 52:57

Yeah, I want to I want to have you pop up one more URL there, it's not live, it will be in 10 minutes. And it's exit for nerd.io. Forward slash how to exit the number two, how to exit. If you go to that URL, exit printer.io forward slash how to exit, you can get a free digital copy of the exit printers playbook. It is the real thing. 300 pages, you can also buy it on Amazon, but the digital copy, you can download and read on your Kindle nook, you know, I book that kind of stuff if if you prefer the digital, and I'm going to do it for your audience only?

Ronald Skelton 53:37

Well, so we'll put that in the show notes and make sure it's in the description one more time because I didn't type it fast enough and run it outside. So one more time, what was it?

Joe Valley 53:48

Exit printer.io. Okay, forge slash, how to exit and the number two in there.

Ronald Skelton 53:54

All right, I will definitely make sure that that's in the show notes a description. So if you're on Spotify or Apple, you'll be able to go to the show notes. And that where you can go to how to exit.com how the number two exit.com. And the when the podcast is live, all the transcription, everything will be on there. So there'll be able to see the video and see the transcription and all the show notes and links. So because I absolutely want people to work with the, you know, those out there in the marketplace that will truly get them the best value. You know, as the buyer, I want a discount but I'd rather buy at a buy it right, you know, from a brokerage that really did the numbers right and maximize what the seller is getting. Then buy something at a risk at a discount and find out about a mess. Yeah, so I'm a proponent of let's do this job, right. Make sure every you know, make sure it's a win win for both parties. And the only way to do that is to truly figure out who's on your team and who has the experience to get it done right. So I appreciate your time. hang out for a few seconds after the show. And again, appreciate you for being on it.

Joe Valley 54:59

Thanks for Add me on appreciate it. One more URL there, it's not live it will be in 10 minutes and it's exit for nerd.io forward slash how to exit the number two how to exit. If you go to that URL exit printer.io forward slash how to exit. You can get a free digital copy of the exit printers playbook. It is the real thing. 300 pages. You can also buy it on Amazon but the digital copy you can download and read on your Kindle nook